The Salkku Markets Outlook for Q1 2026 adopts a positive stance for global stock markets over the next 12 months, with clear improvements in both the Salkku Coincident Indicator and Salkku Leading Indicator over Q4 2025.

Executive Summary

Global economic conditions remain resilient entering 2026, with the Salkku Coincident Indicator signaling continued expansion (0.8 reading as of early January) amid stable business activity in manufacturing and services. The Salkku Leading Indicator (0.17) points to modestly above-average stock market returns over the next 12 months. Consensus forecasts from institutions like the IMF and World Bank project global GDP growth around 2.6–3.3% in 2026, supported by AI-driven investment and easing policy headwinds, though tempered by trade uncertainties and softening momentum in some regions. Overall, the outlook supports a cautiously optimistic stance for global equities, with potential for solid but not exceptional returns, contingent on sustained earnings growth and contained inflation.

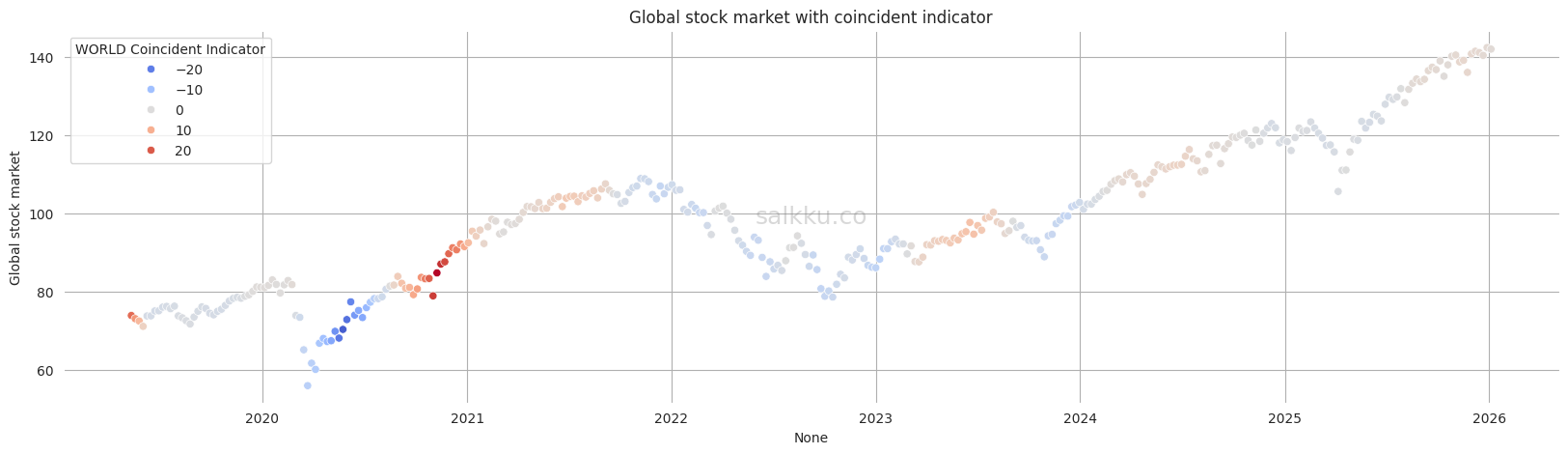

Salkku Coincident Indicator for Global Markets

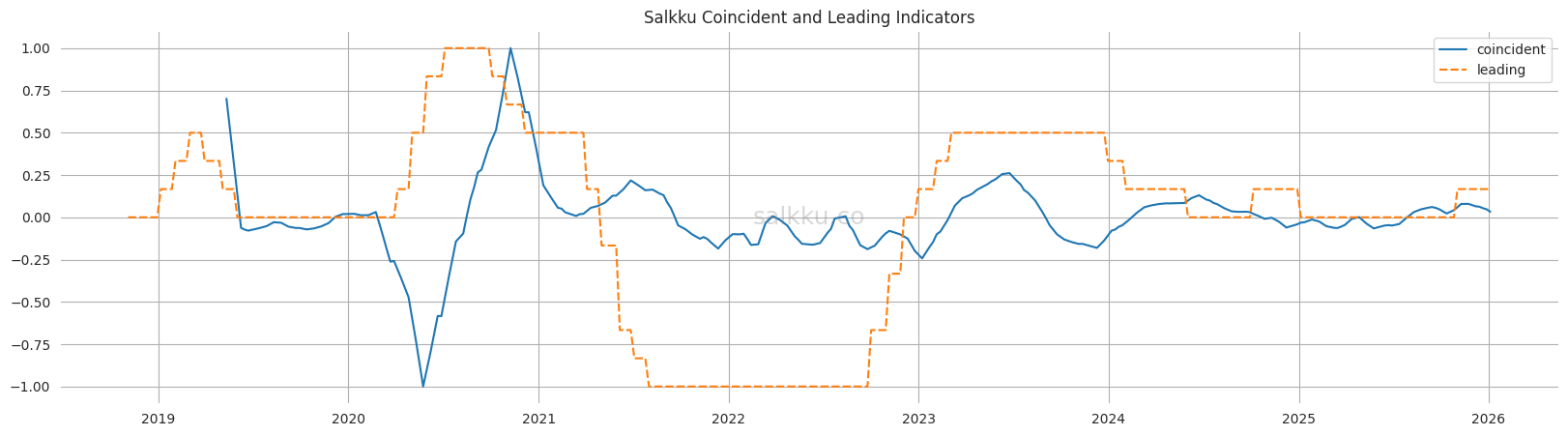

The Salkku Coincident Indicator tracks the current state of the global economy, primarily through the Composite Global Purchasing Managers’ Index (PMI), which measures business activity in manufacturing and services sectors.

As of January 04, 2026, the Salkku Coincident Indicator recorded a positive reading of 0.8, continuing with strong Q4 readings. This reading is consistent with ongoing global expansion, corroborated by recent PMI data showing the J.P. Morgan Global Composite Output Index at 52.0 in December 2025 (released in January 2026), though slightly lower than prior months, reflecting moderated but still positive momentum.

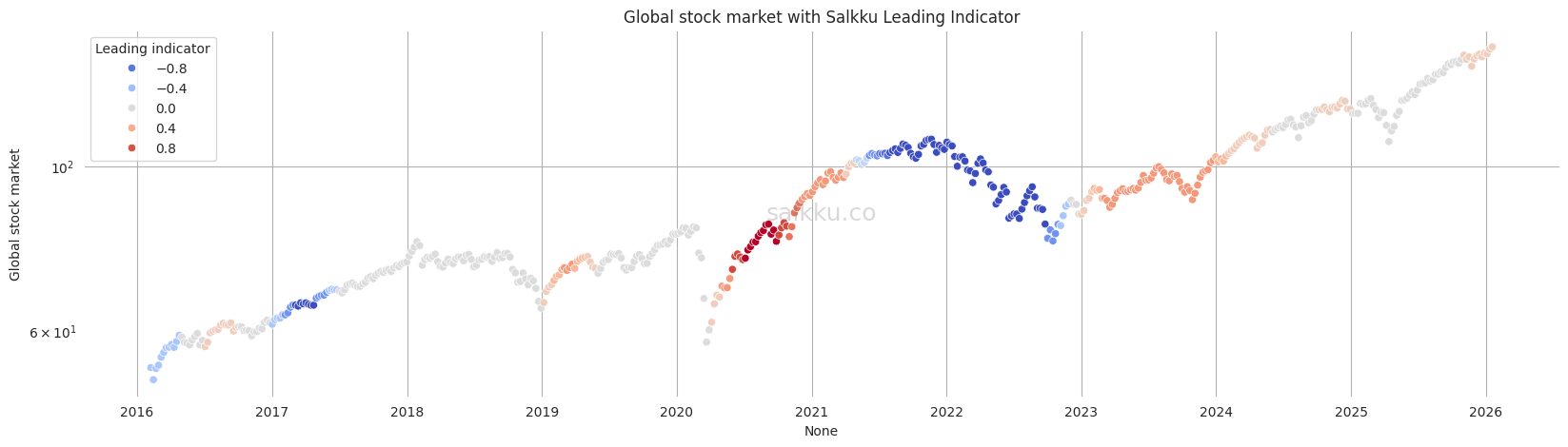

Salkku Leading Indicator for Global Markets

The Salkku Leading Indicator aggregates forward-looking metrics, including economic sentiment, manufacturing orders, and financial market signals, to predict global stock market performance over a 12-month horizon.

In January 2026, the Salkku Leading Indicator registered a positive reading of 0.17, indicating that global stock market returns are expected to be slightly above long-term averages over the next 12 months. This is backed by broader market expectations of resilient growth driven by technology investments.

Regional Outlook for Global Stock Markets

See detailed Salkku Indicators for United States.

See detailed Salkku Indicators for Eurozone.

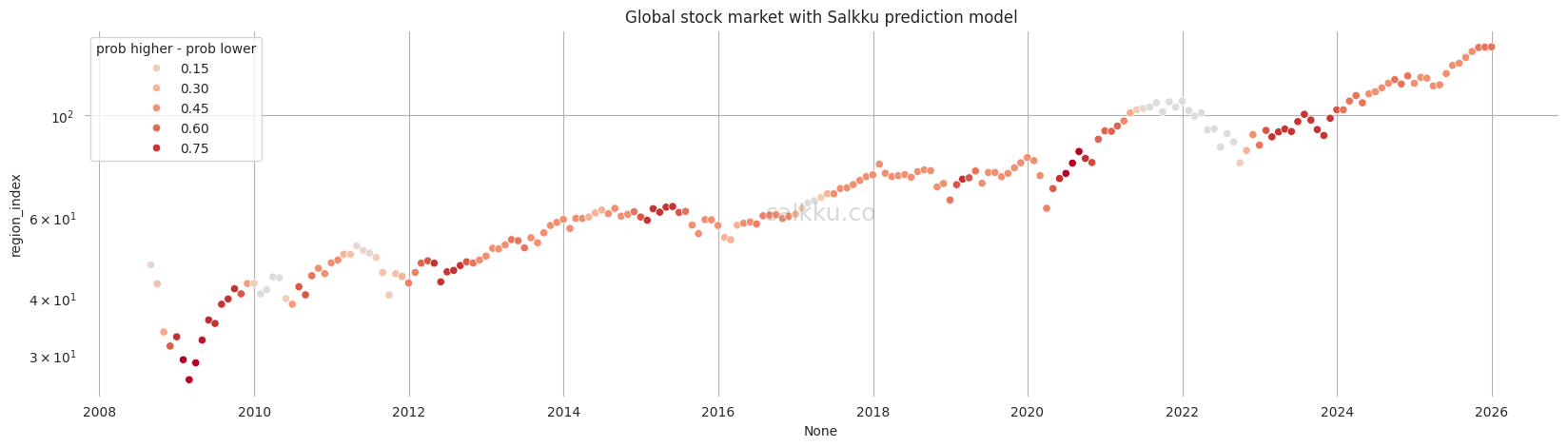

Model Prediction

The global market outlook has improved steadily during 2025, with the Salkku machine learning model now forecasting positive stock market returns over the next 12 months with a 73% probability.

Risk asset cycles

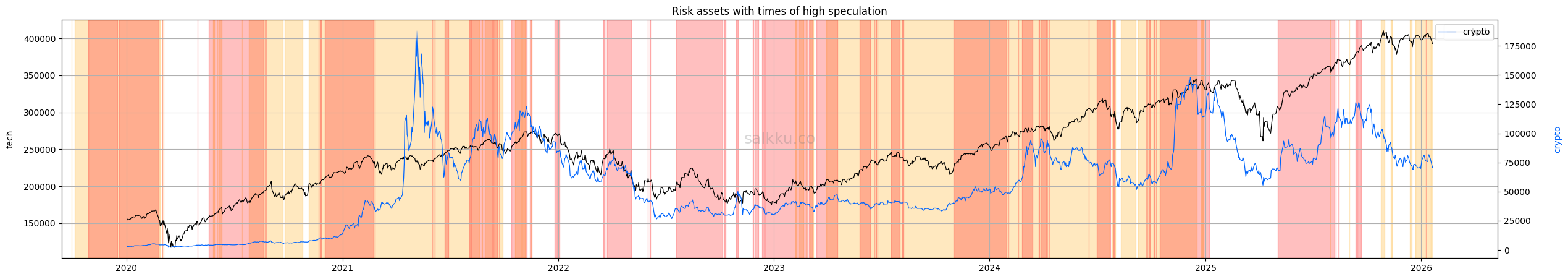

We have identified certain cyclicality in risk assets, which have played out fairly reliably over the past decades. Markets seem to follow a longer term multi-year cycle and shorter multi-month (<1 year) cycle. Risk assets with most beta to this cyclicality are especially tech stocks, and cryptocurrencies, with commodities having a smaller, but non-zero, beta.

Figure 4. is showing a resumption of the most expansionary/speculative phase of the multi-year cycle (in yellow) since end of 2024Q4. This phase of the longer cycle has previously been very good for cryptocurrencies and tech stocks. Shorter term multi-month cycle (in red) is still rebounding after bottoming in Q4. This phase of the shorter cycle has previously been very good for cryptocurrencies.