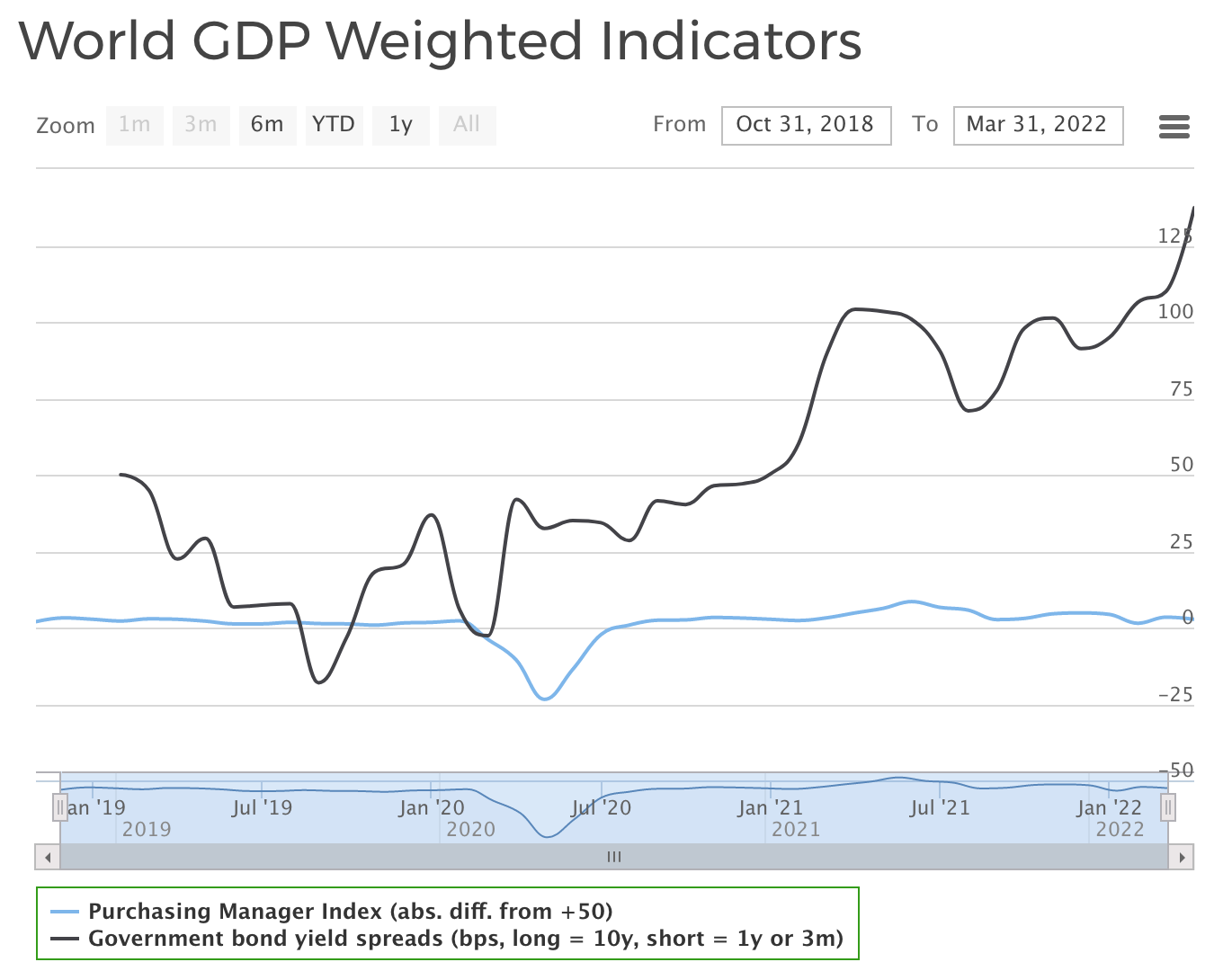

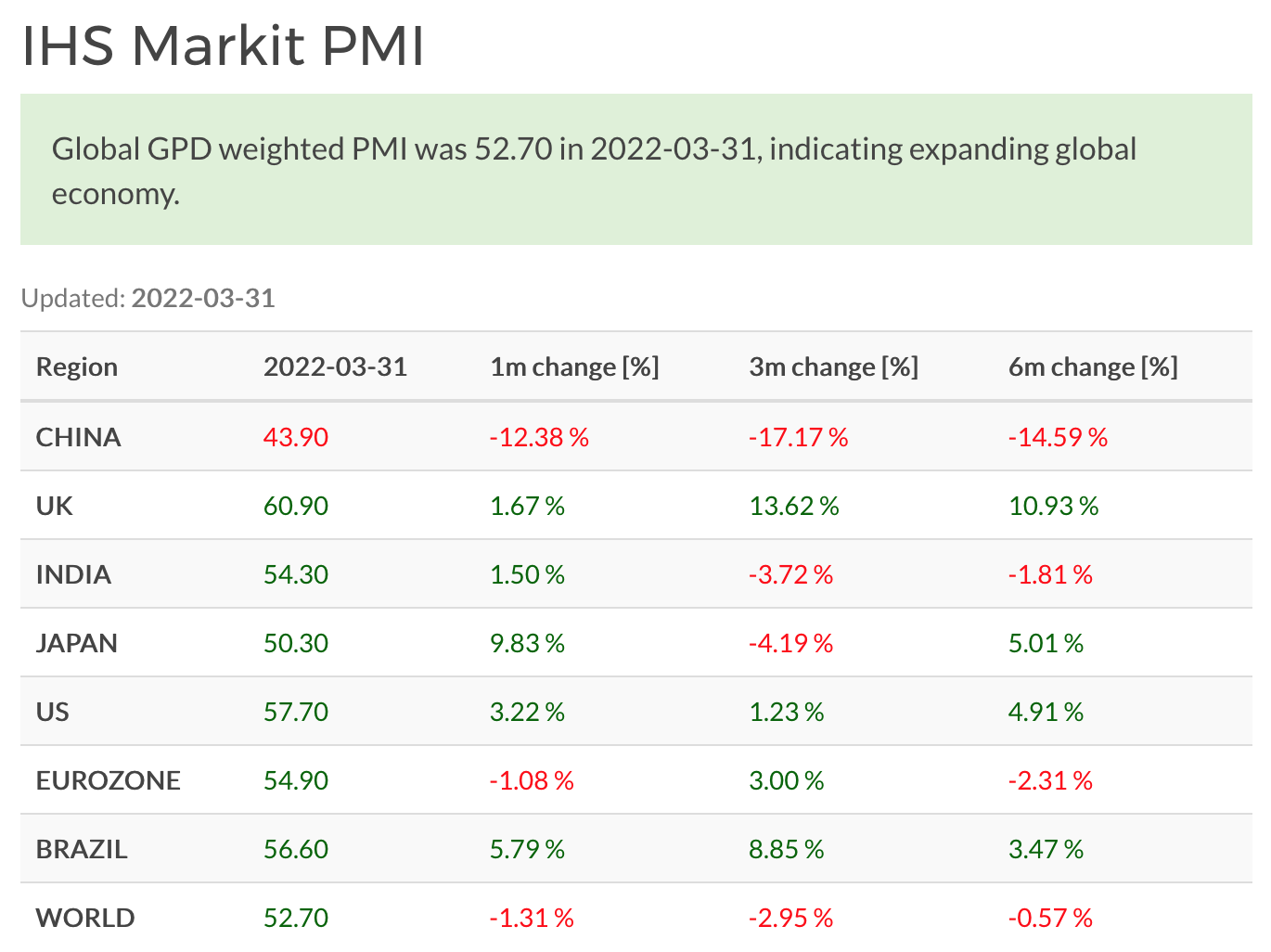

Salkku economic indicators for Q2/2022 are indicating a mostly growing world economy. World Composite PMI is slightly down because of lockdown induced crash in China composite PMI but still over 50 indicating expanding global business outlook. World government bond yield spreads still widened compared to Q1/2022.

Healthy outlook in all major economies except China

World Composite PMI was 52.7, indicating positive expectations for combined service and manufacturing sectors. All major economies except China have composite PMIs over 50. China has been forced to introduce widespread lockdowns according to their pandemic handling policy, and so their PMI has plunged to 43.9, which signals sharply contracting economic outlook. That has brought global PMI also down a bit from Q1/2022.

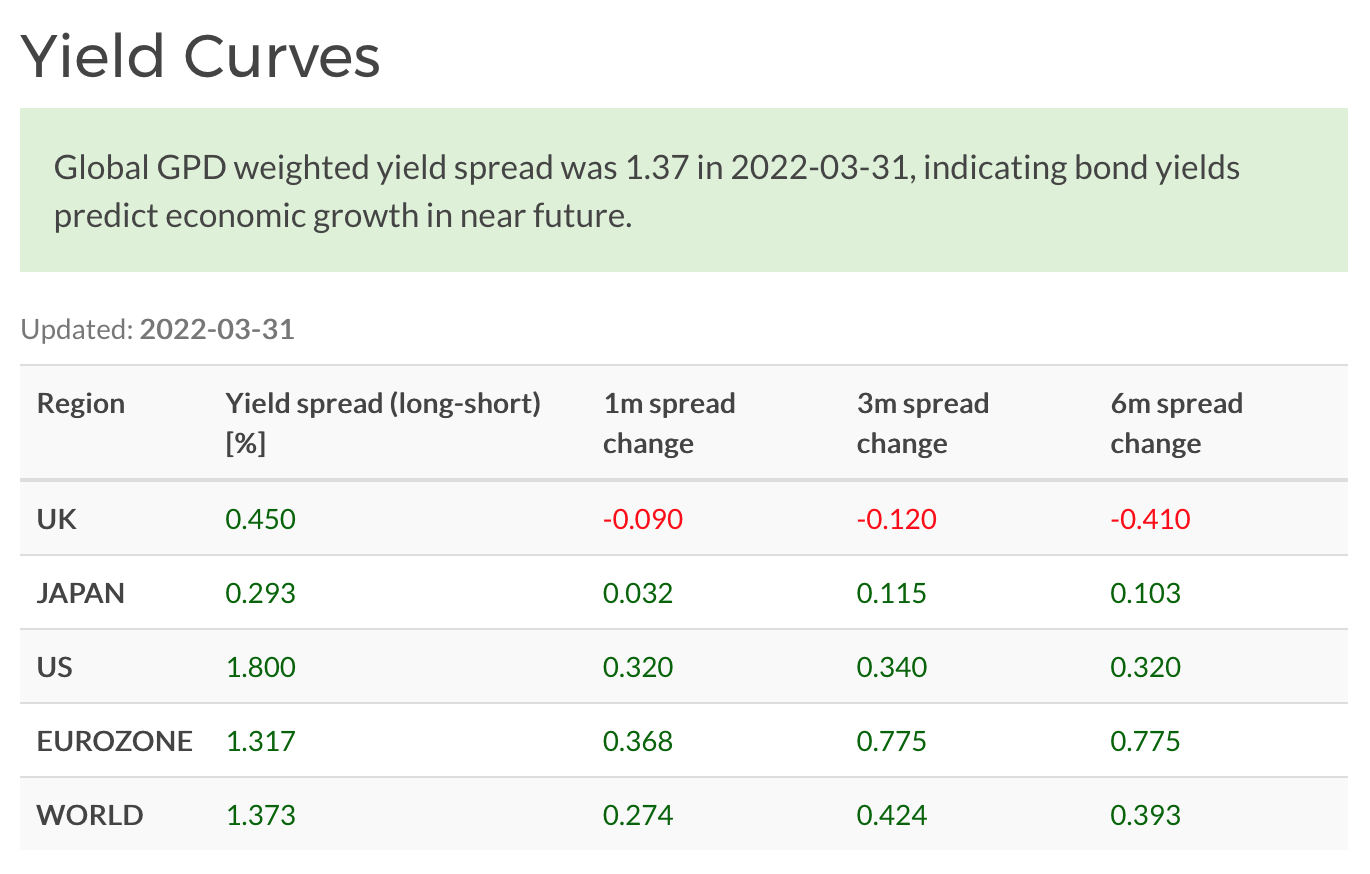

Yield spreads have continued to widen when measured between shortest and 10 year duration government spreads. Market coverage has focused on recent inversion between 2 and 10 year spreads in USA. However, better indicator for economic outlook is the spread between short end (3 months - 1 year) and 10 year spread, because that roughly maps the profitability for banks to loan money from markets (short end) and lending it out with yield (long end), therefore indicating if banks are incentivized to make loands to businesses and contribute to economic growth.

Thoughts on Q2/2022

World stock markets in aggregate have been down for the year so far. Inflation story has probably scared some investors, there has also been uncertainty with regards to war in Ukraine. Since economic indicators do not signal a slowdown being on the cards, this looks like an excellent opportunity to be on the markets when going to summer.