World economic leading indicators imply still expanding global conditions for Q4/2019 in September. Both LEI (Leading Economic Indicator) and composite PMI data signal growing economic activity.

Leading indicators signal expansion

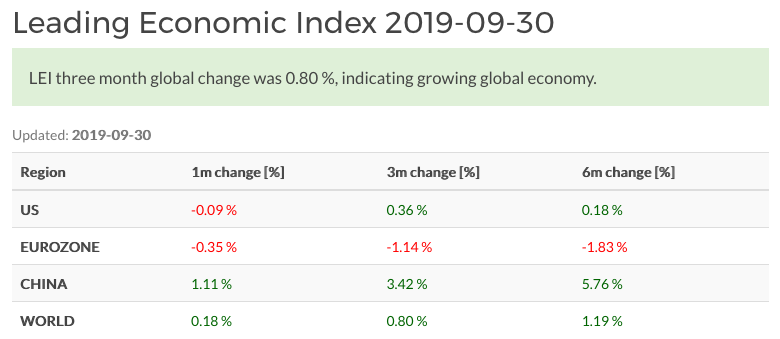

In September, Leading Economic Index by The Conference Board indicated growing economy in US and China, while eurozone index signaled contraction. World growth is still largely driven by China, followed closely by US. GDP weighted world LEI based on these three biggest economies was growing in one, three and six month timescales.

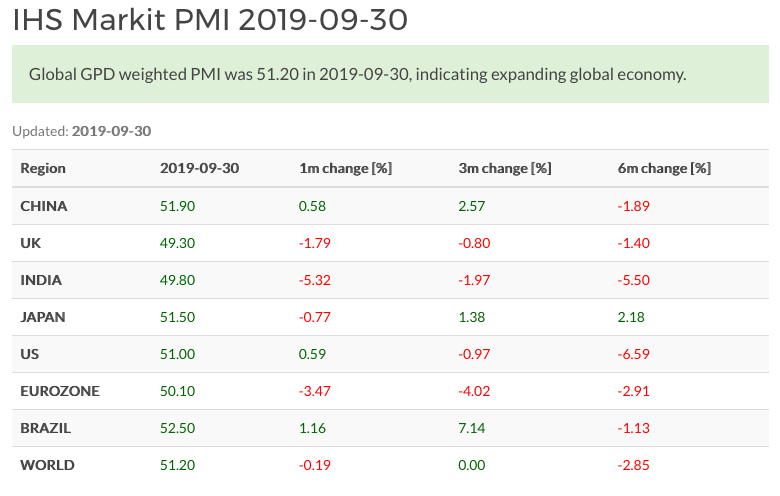

World Composite PMI was 51.20 in September, indicating robust growth for the coming quarter. Only India and UK PMI figures signalled slight contraction. Often cited manufacturing weakness is largely offset by robust growth in services. Consumers are largely supporting global economy for now.

Bad news are already in prices

Bad news for economy, like Brexit and US-China trade war have by now already been discounted on stock prices. Therefore, in the Q4/2019 even slight indications of positive development, or signals of lessening impact to world manufacturing could provide a significant tail wind to markets. When expectations are negative, even slight hints about positive developments can be enough to turn the market sentiment.