World economic leading indicators pointed to expanding global conditions for Q1/2020 in November. Both LEI (Leading Economic Indicator) and composite PMI data signalled growing economic activity.

Leading indicators signal expansion

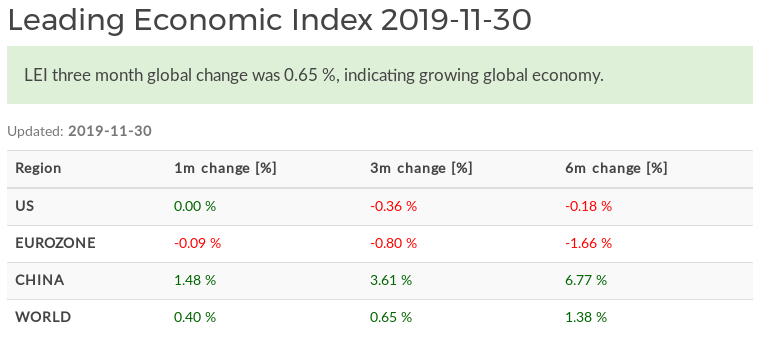

In November, three month change of Leading Economic Index by The Conference Board indicated growing economy in China, while US and eurozone indexes signaled contraction. Growth in China was so strong, that it more than accounted for slight contraction in US and eurozone outlook. GDP weighted world LEI based on these three biggest economies was growing in one, three and six month timescales.

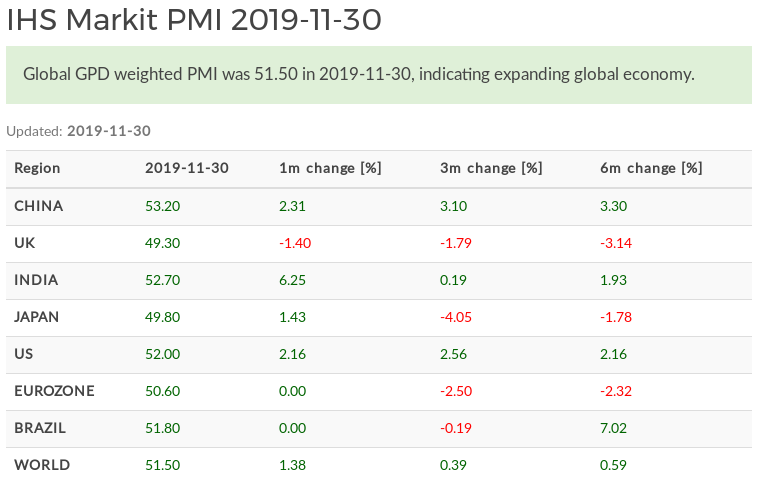

World Composite PMI was 51.50 in November (51.20 in September for Q3 outlook, so things have somewhat improved), indicating solid growth for the first quarter of the year. All of the individual composite PMI figures except UK signalled slight expansion. Often cited manufacturing weakness is largely offset by robust growth in services.

2019 in perspective

2019 showed us how important it is to not get carried away by news headlines. Anyone who convinced themselves imminent economic deceleration was coming or had already started, got sidetracked as markets kept improving. To try to get a solid view on economy, it is important to follow indicators which capture global economy in it’s entirety (biggest companies are global too) and that take into account all industries and services, not just those making biggest movements, like manufacturing in developed economies last year.

For long term stock market investors, it’s usually better to do nothing than to do something and risk missing out on market growth. Long term economic growth (spanning multiple cycles) and therefore stock market trend is up, rather than down.