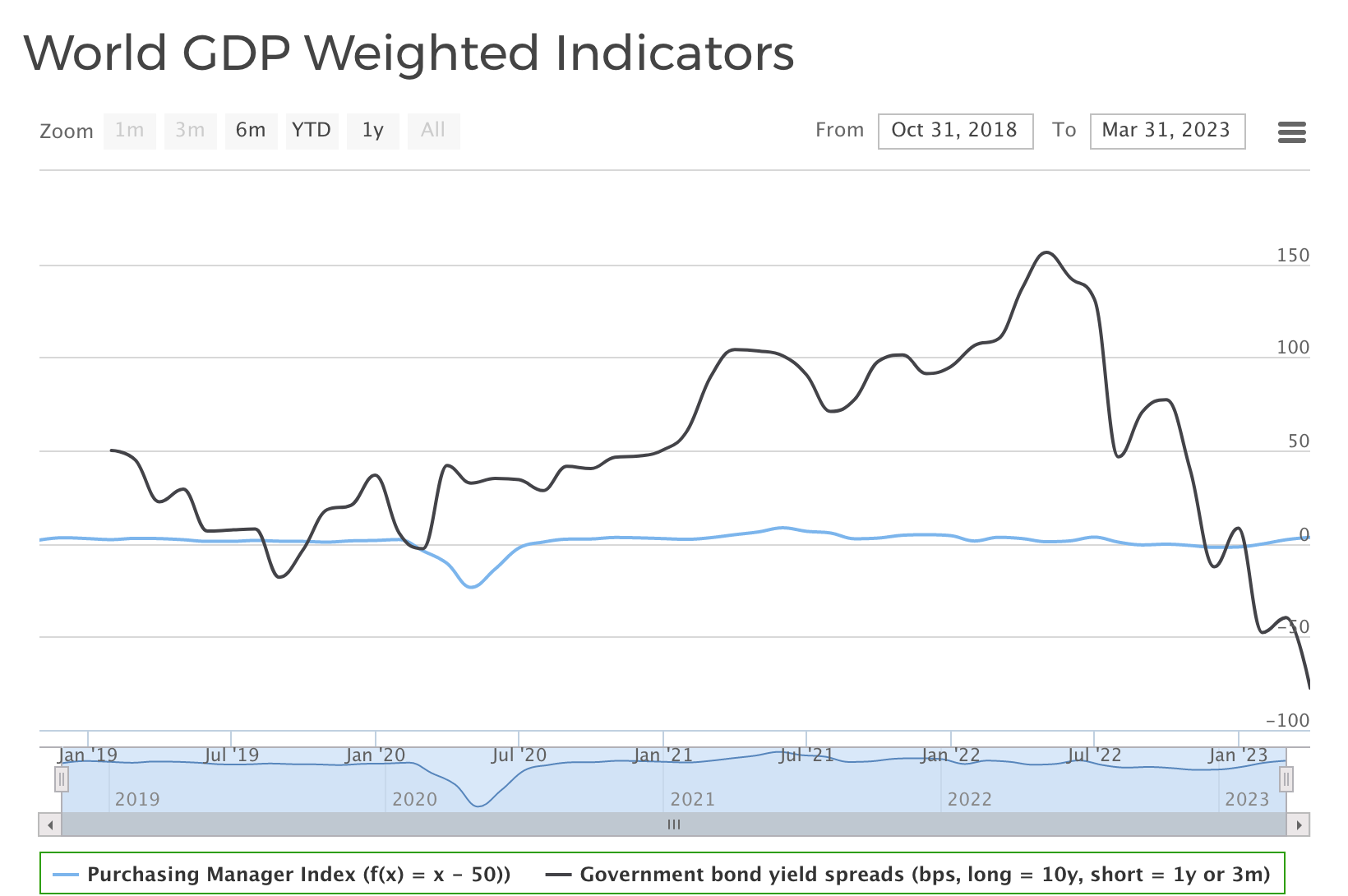

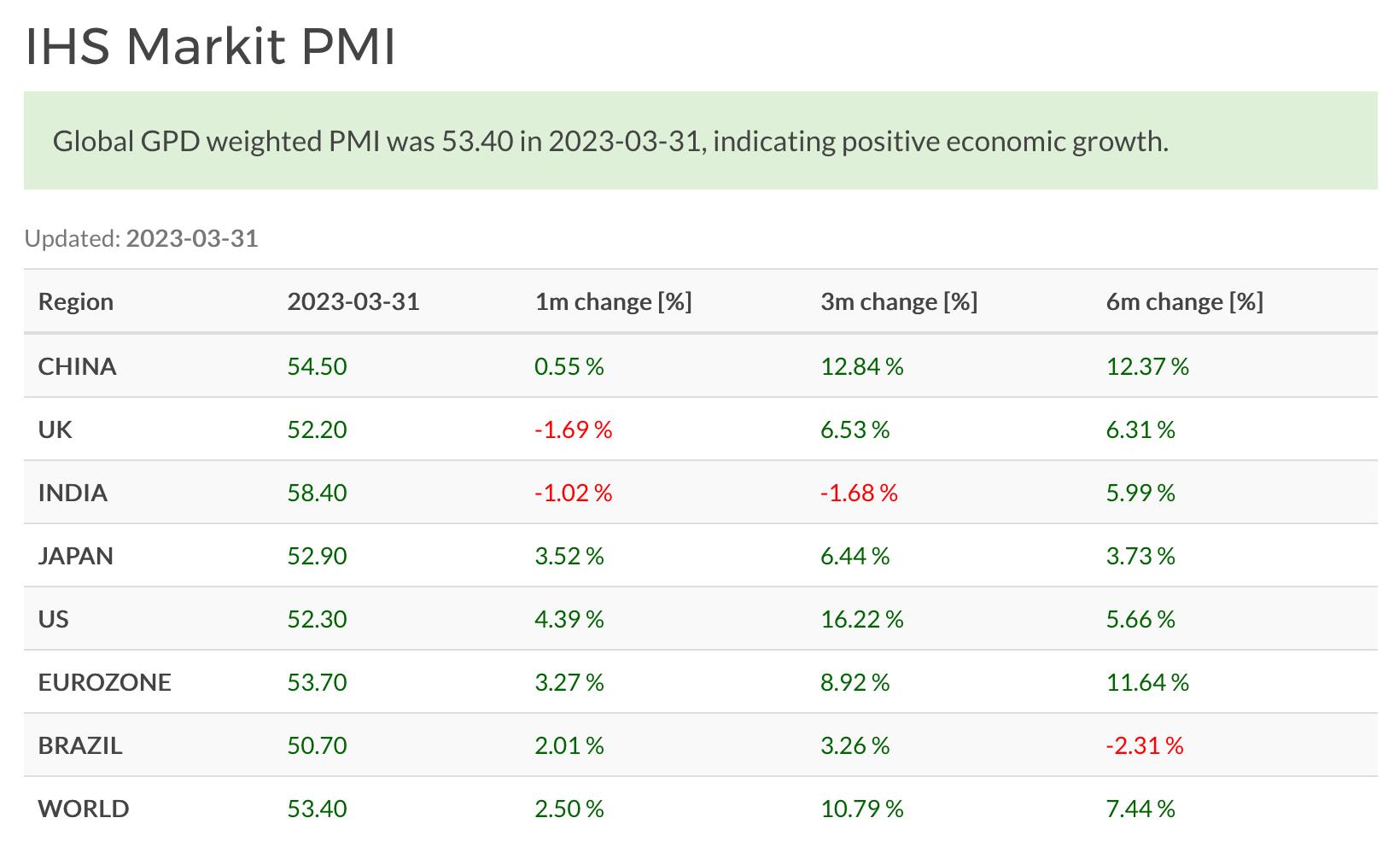

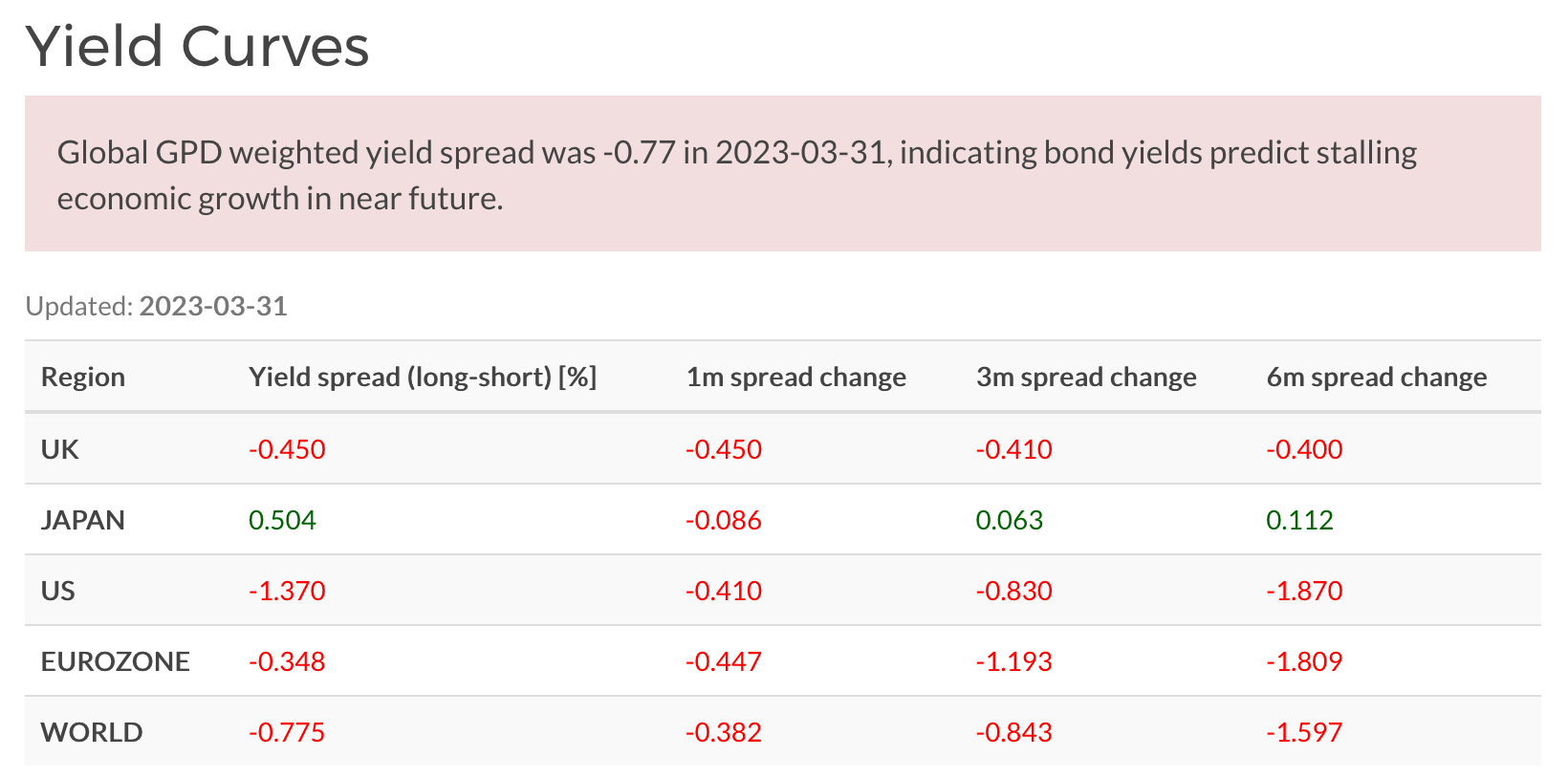

Salkku government bond yield spread index has now fully inverted, indicating recession sometime in 2023/24 in developed economies. However, short term economic outlook has improved materially with World PMI composite index showing strong economic momentum since the start of the year.

PMI weak, yield curve inverted

World Composite PMI was 53.4 in March, indicating favourable short term economic outlook. World composite PMI started to show signs of economic expansion in February, and has continued the positive momentum in March.

Aggregate yield curve for major developed economies has been fully inverted for entire Q1. Now all of the major developed economies besides Japan have inverted yield curves.

Thoughts on Q2/2023

Recession signal is still strong for medium and long-term outlook, indicating recession to start sometime in 23/24. Recent trouble in banking sector is also exposing difficult operating environment stemming from rapidly rising interest rates. Many people who were following markets in 2007 remember how banking sector troubles were a harbinger for difficult times ahead back then. It seems financial sector on aggregate is not very stable, and even modest headwinds require government intervention.

Steepening yield curve inversion has meant that long-term rates have started to come down in US and Europe. This means that bond markets are expecting rates to drop significantly in medium to long-term, because of central bank easing during recession. This should help households struggling with high mortgage rates and soaring cost of living from high inflation.

In last outlook I wrote that “Absense such a catalyst now, it is likely that stock markets have already priced in the slowing economy and moderating earnings, and we might see a positive year in the markets”. It turns out stock markets had indeed priced in slowing economic outlook, and markets started to improve rapidly at the start of the year. Looming recession is not in itself a reason to worry, because of the tendency of the market to already price in falling earnings. Recent banking troubles were not strong enough catalyst to upset the markets significantly.