Year 2021 begins with strong growth outlook according to leading indicators. Virus fears have changed to optimism, as businesses and markets are anticipating a year of recovery from the pandemic. This is the baseline scenario now priced in stock market.

Robust growth in all indicators

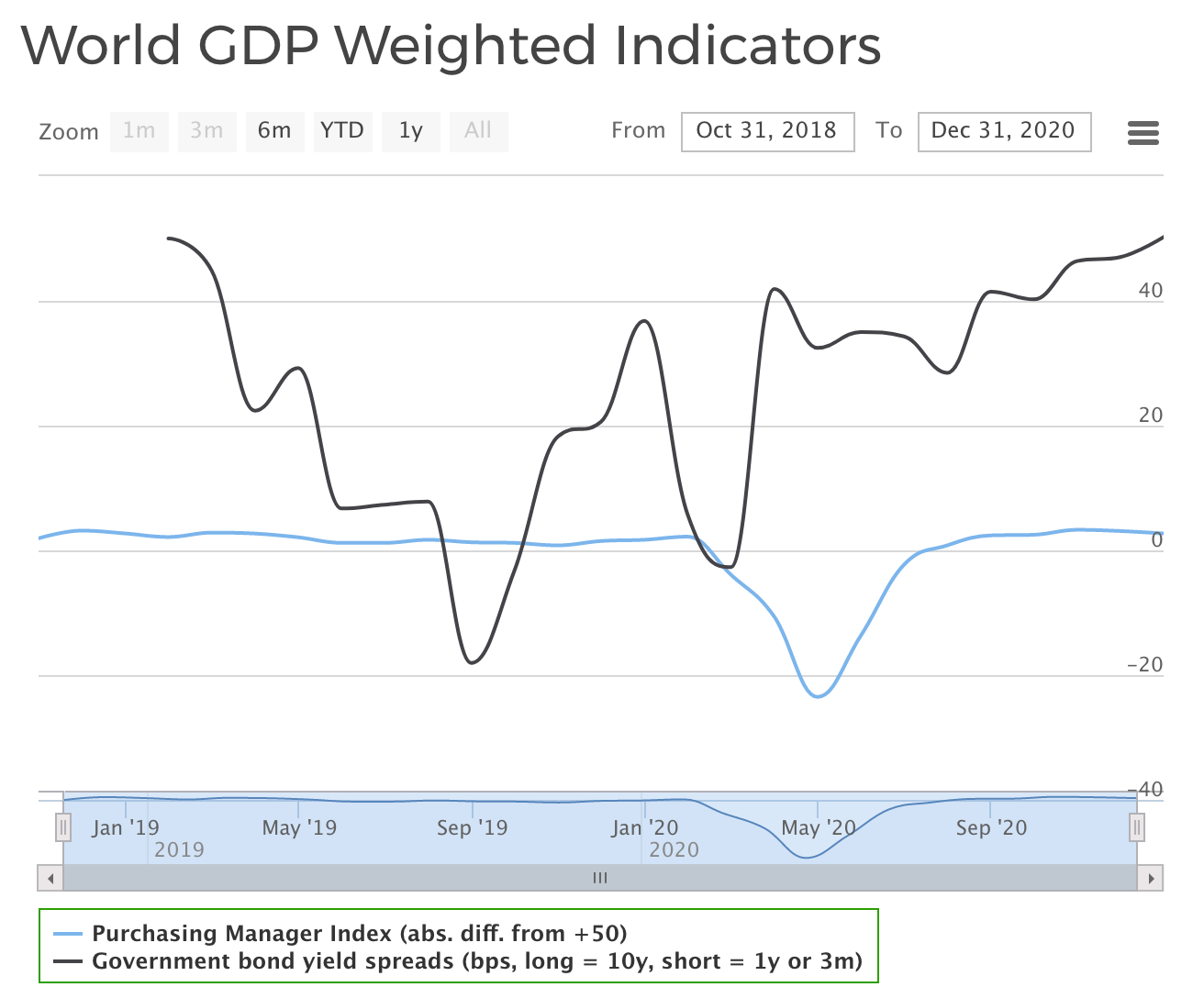

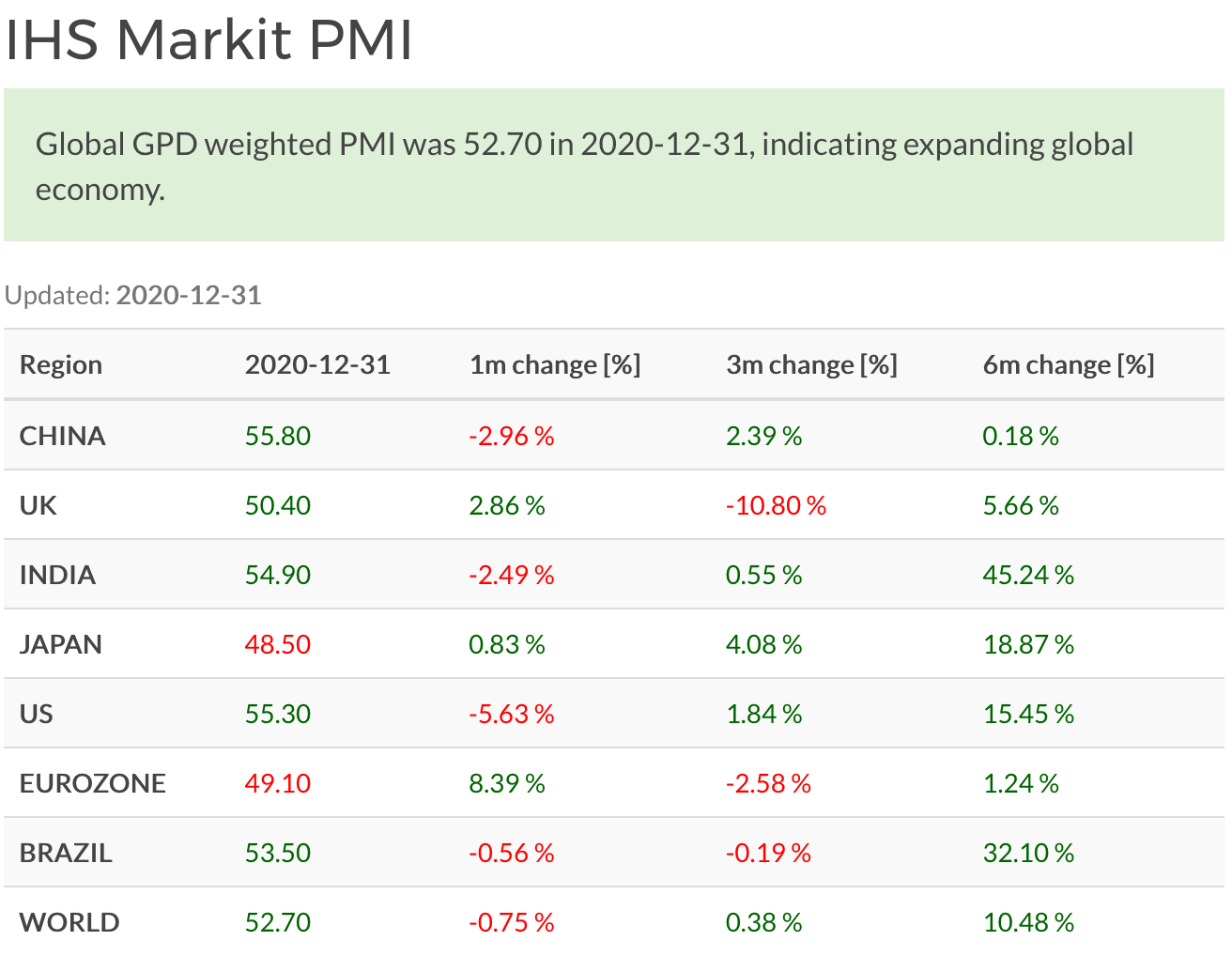

World Composite PMI was 52.70, indicating improving expectations. Only in Eurozone and Japan PMI numbers reflected slightly shrinking economic activity, likely caused by second infection wave restrictions.

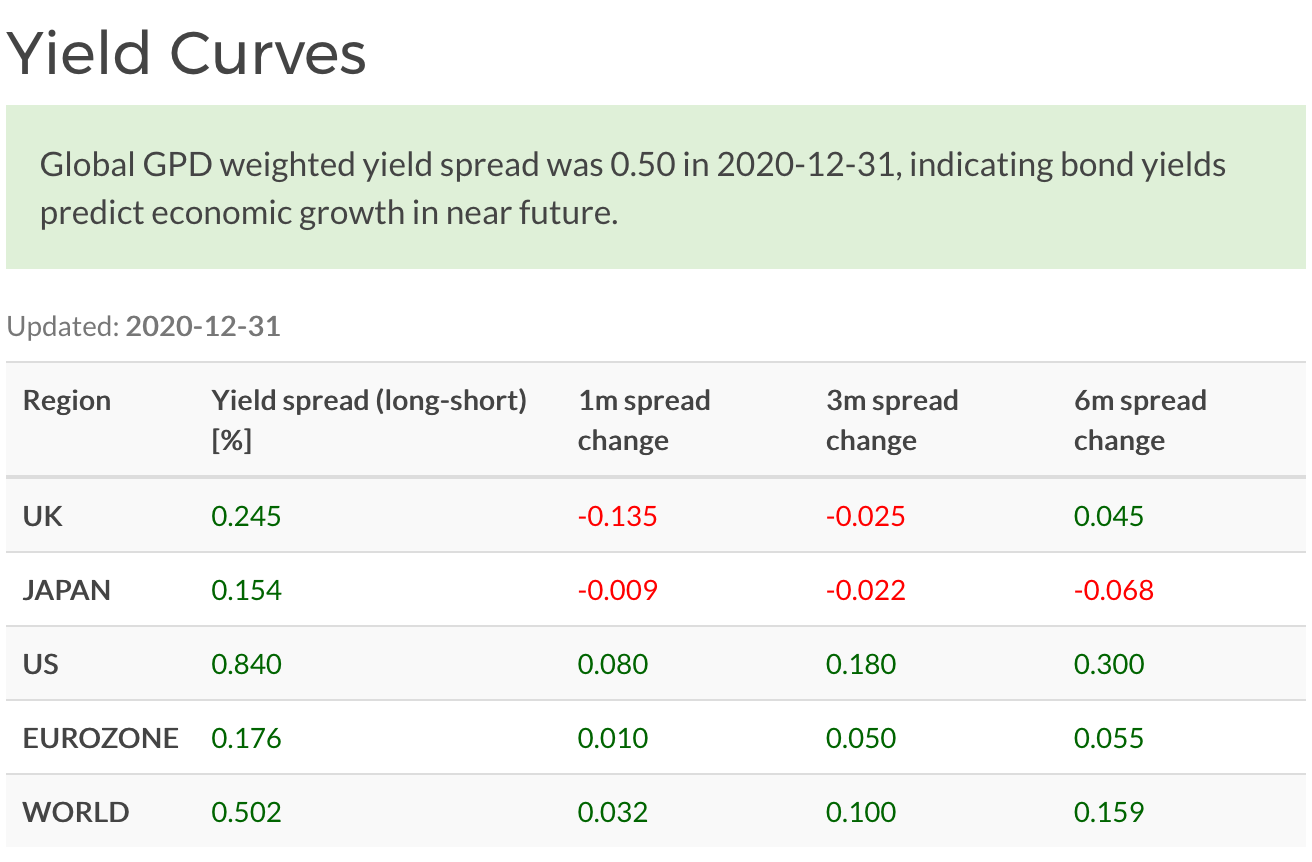

Government yield spreads between long and short duration bonds were also above zero. Also yield spreads have widened across one to six month timeframes. Positive yield spreads indicate favourable lending conditions for banks, so money for investments should find it’s way to businesses in need.

2021 outlook

2021 seems to be shaping up quite nicely. A lot of the improvements are already priced in the market, so 2021 returns depend on whether growth continues in a world where people don’t have to be afraid of meeting each other.