Salkku blog

2025Q3 Salkku Markets outlook for world stock markets: Positive outlook

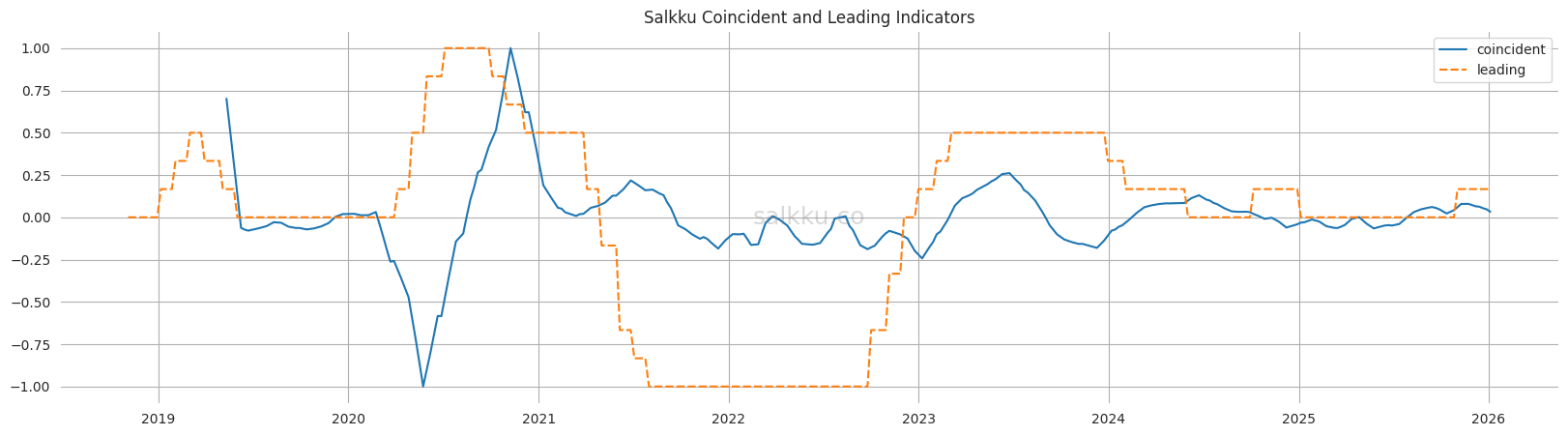

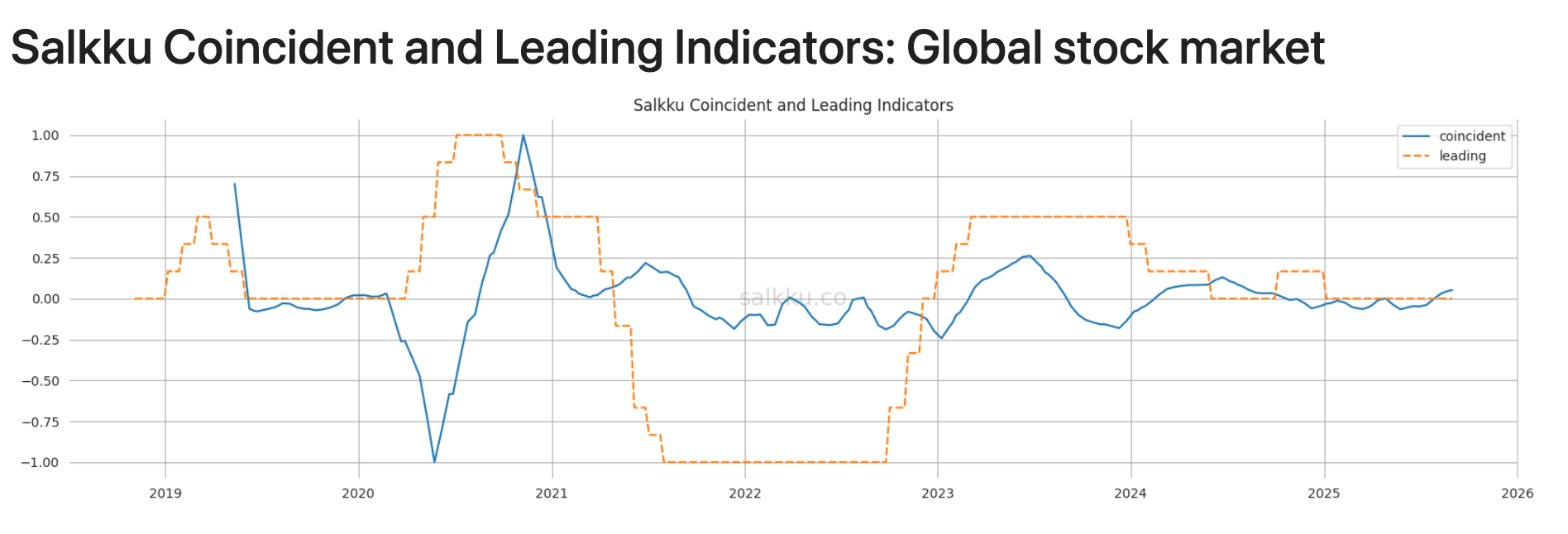

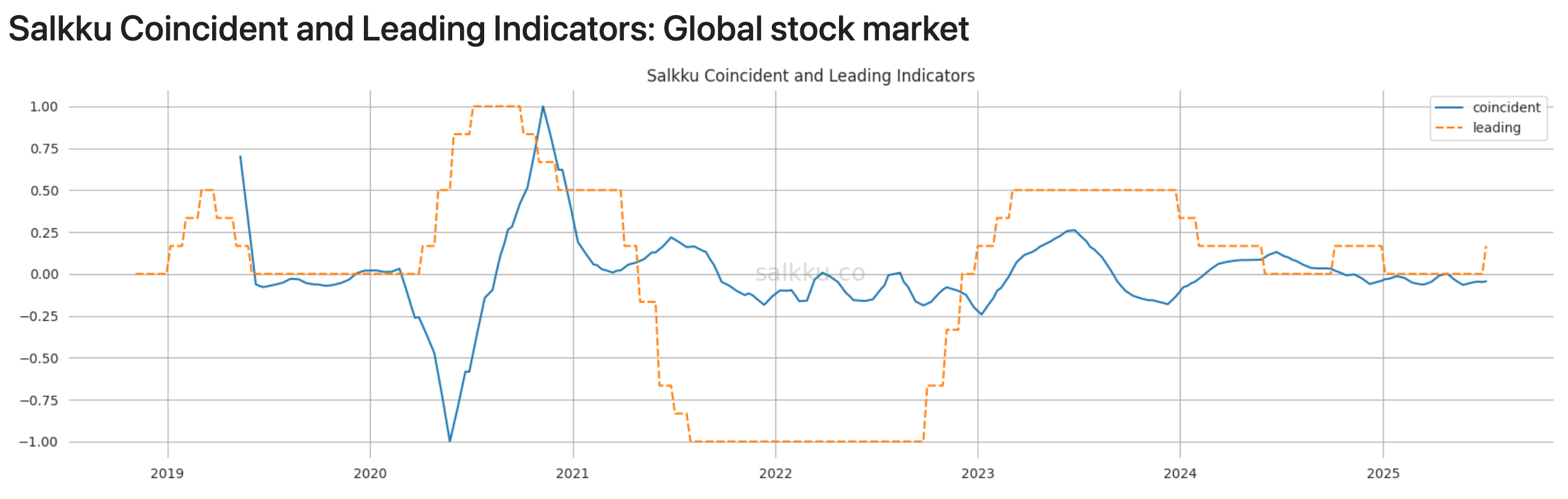

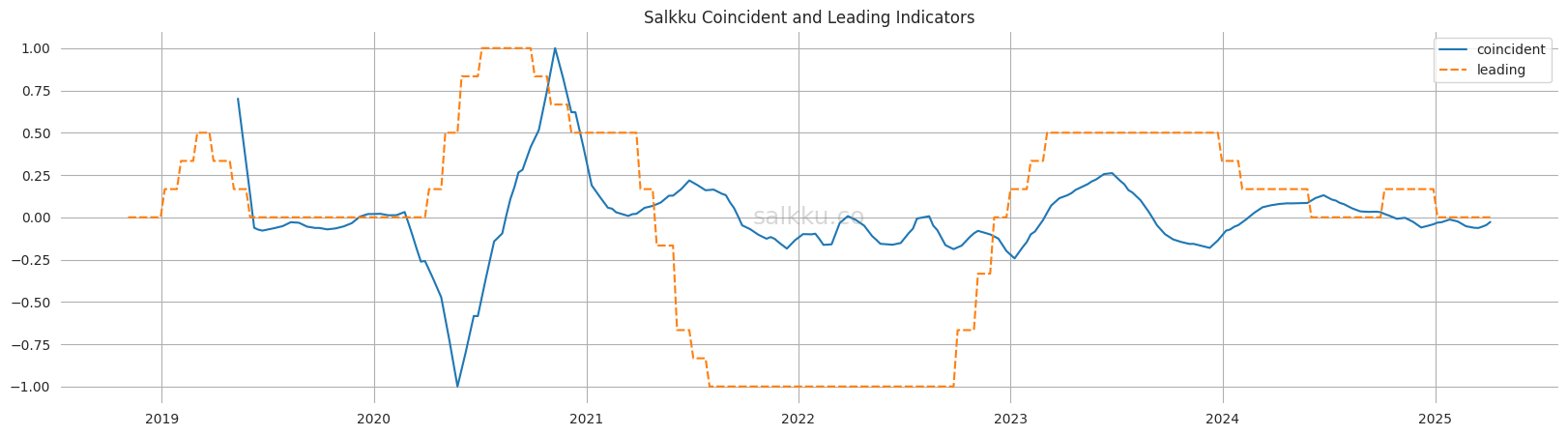

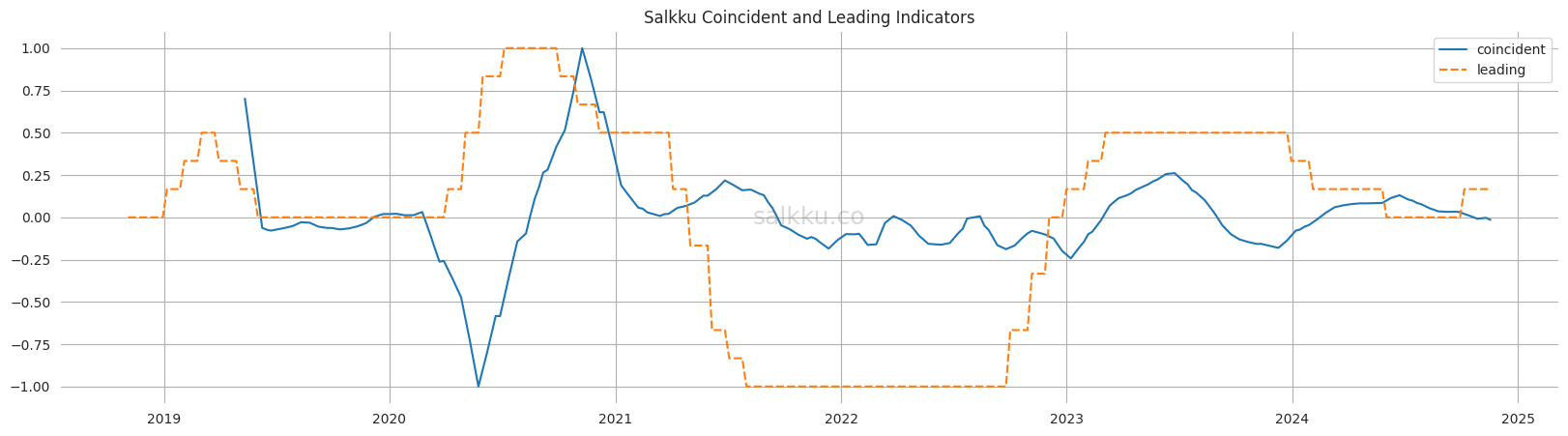

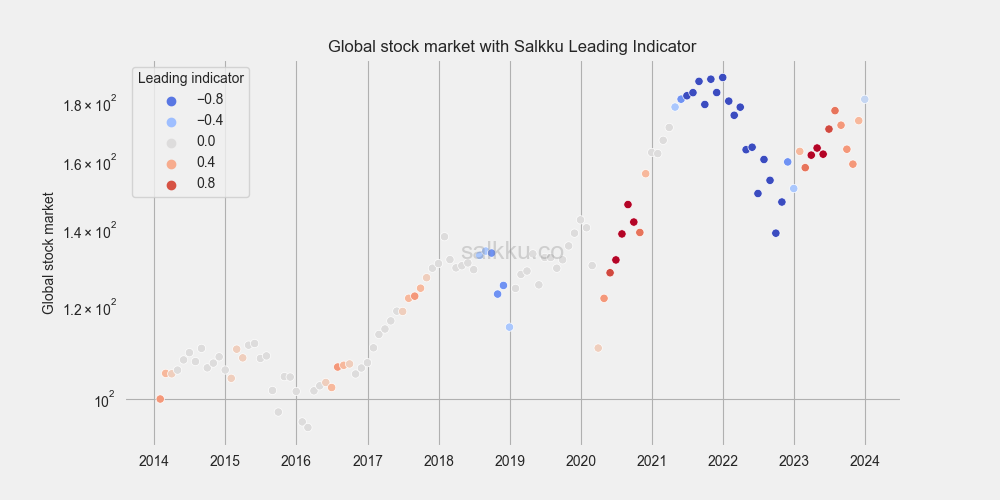

While Salkku Coincident Indicator was slightly negative, Salkku Leading Indicator for world markets was in positive reading in June 2025. Machine learning model based on Salkku leading indicator components is predicting a positive case scenario, which means positive returns for the global stock markets in next 12 months with high probability.

Read more2024Q2 Salkku Market Outlook for World Stock Markets: Neutral outlook

We expanded our coincident and leading indicators to include world markets, which will be the main focus in these outlooks. Our coincident indicator shows neutral reading for world economy, and leading indicator shows neutral outlook for global stock markets in the next 12 months period. Neutral outlook predicts roughly average stock market returns over one year time horizon.

Read more2023Q4 Salkku Leading Indicator for US Markets: Negative outlook

Salkku economic indicators have been redesigned. Previously only two economic indicators were used, namely PMI and government bond yield spreads. Now two types of indicators are analysed here, coincident and leading indicators. Our own leading indicator models are also being built, which uses a collection of indicators to train custom machine learning models.

Read more2023Q1 Q1 World economic outlook

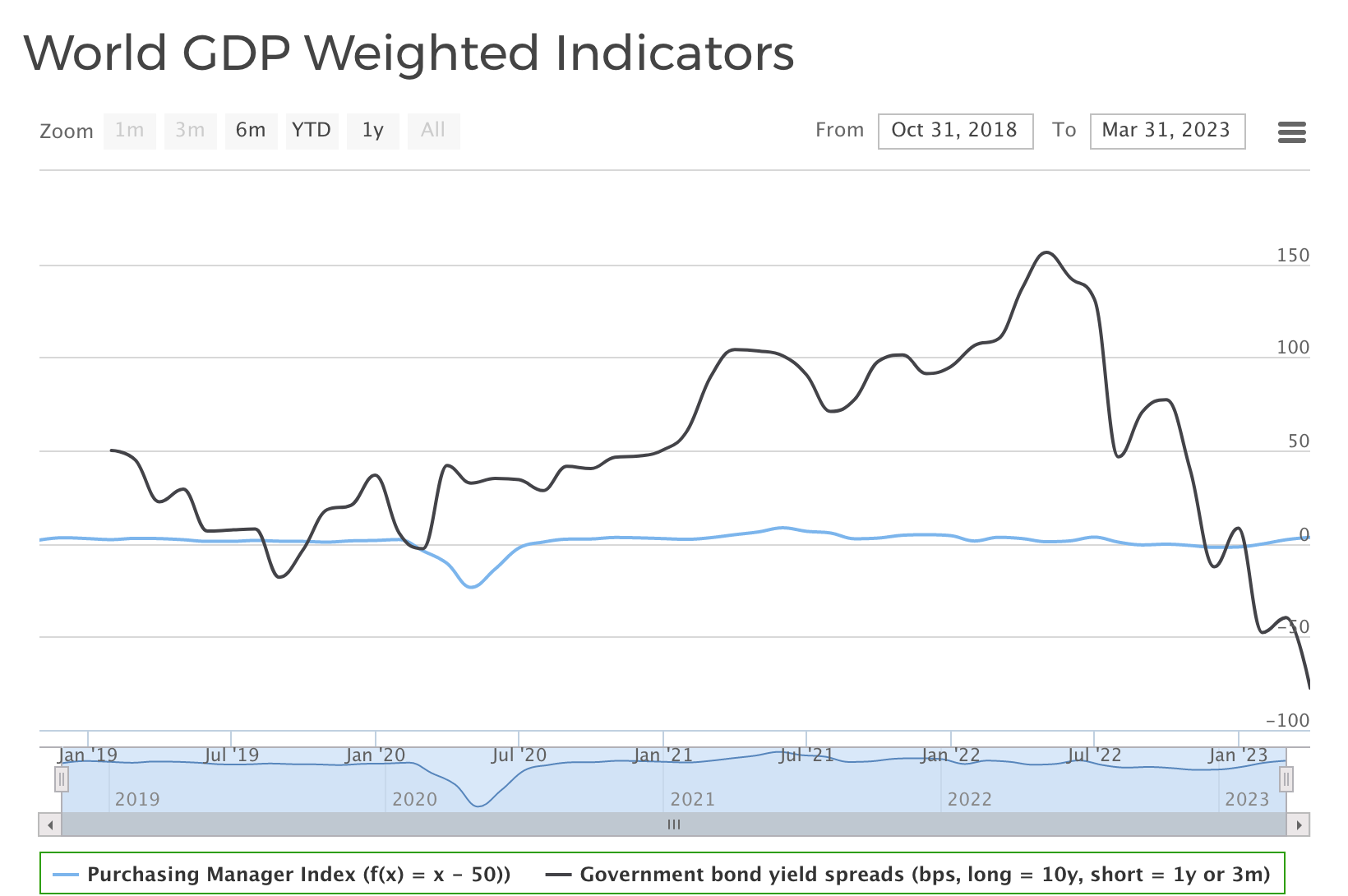

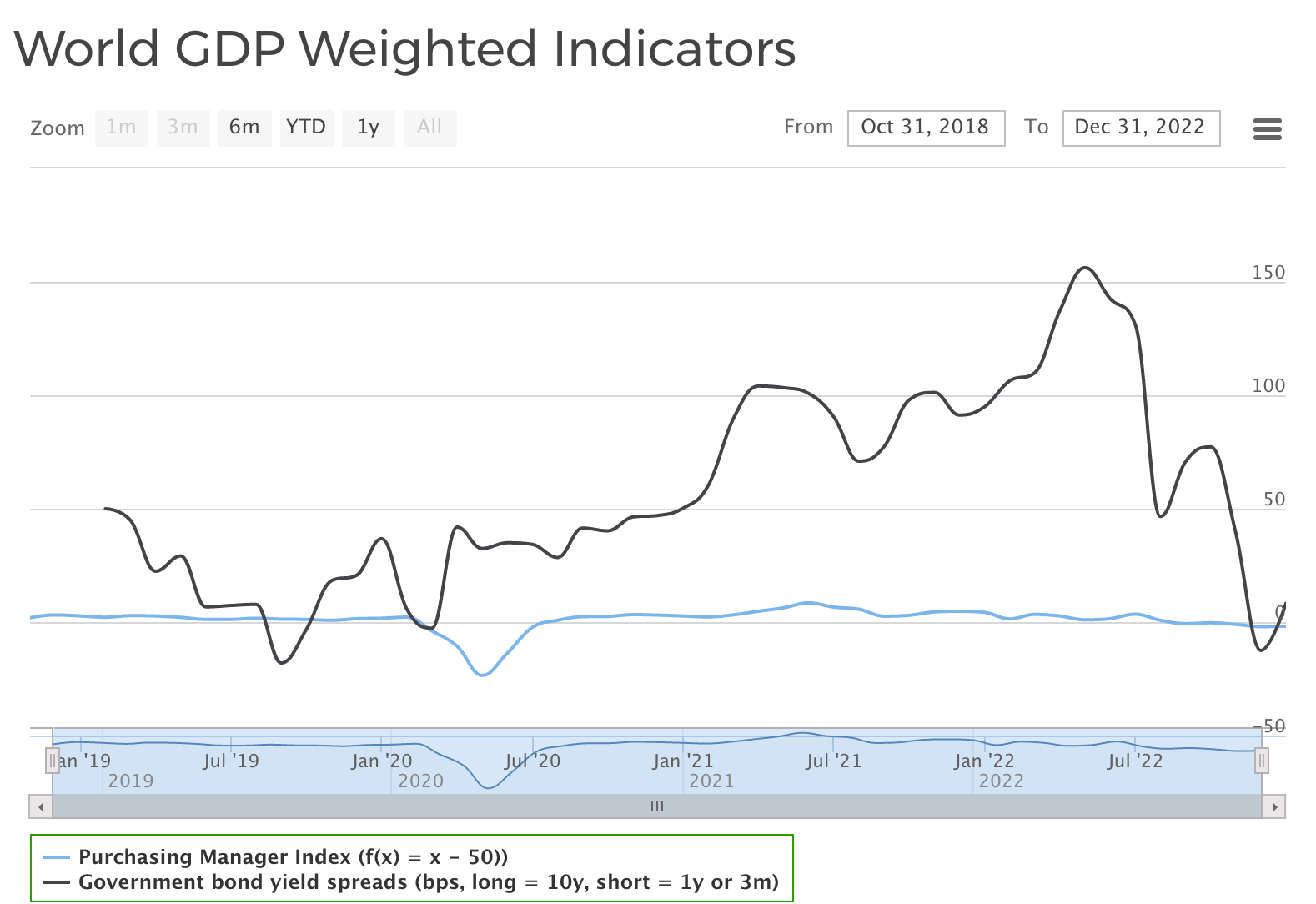

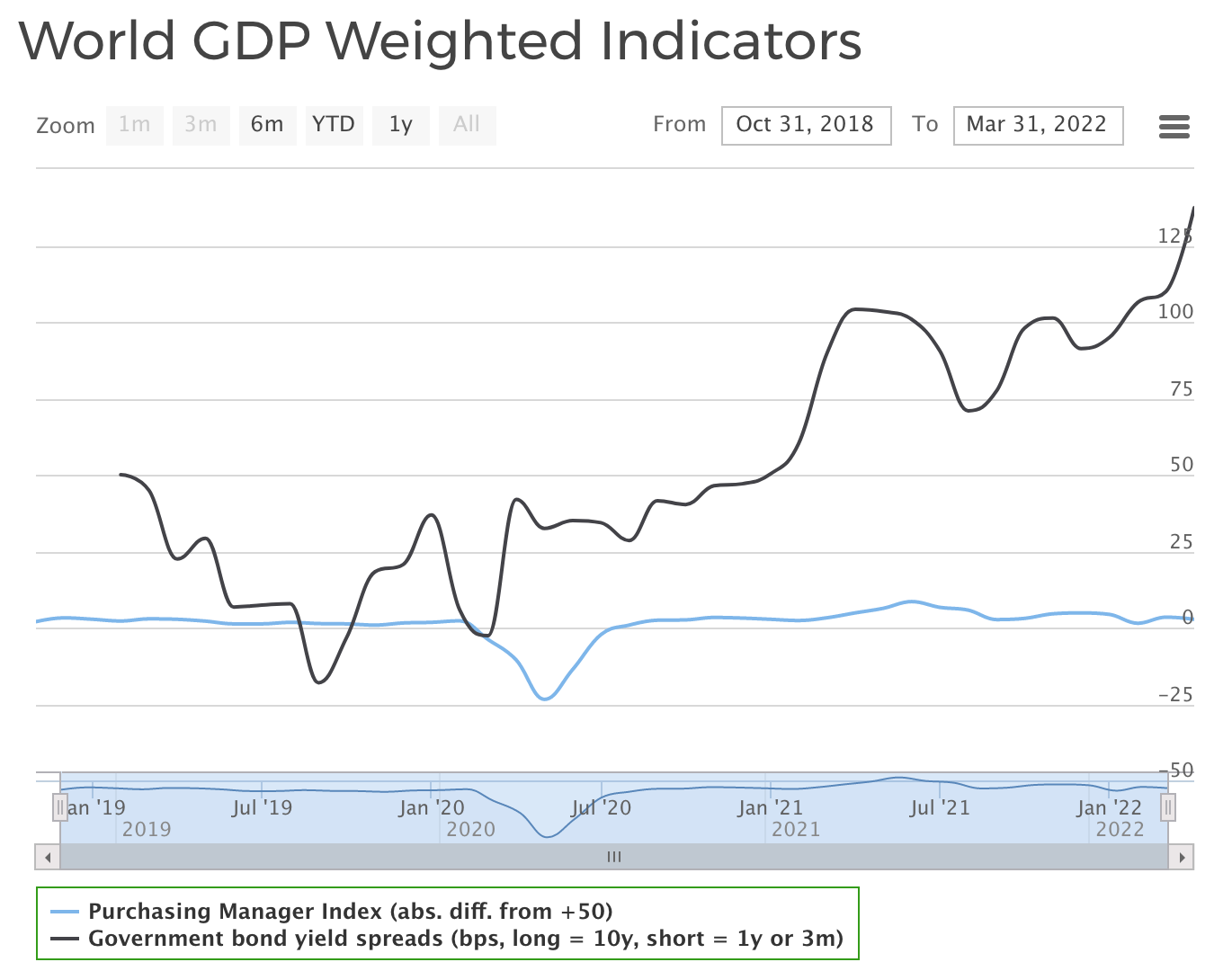

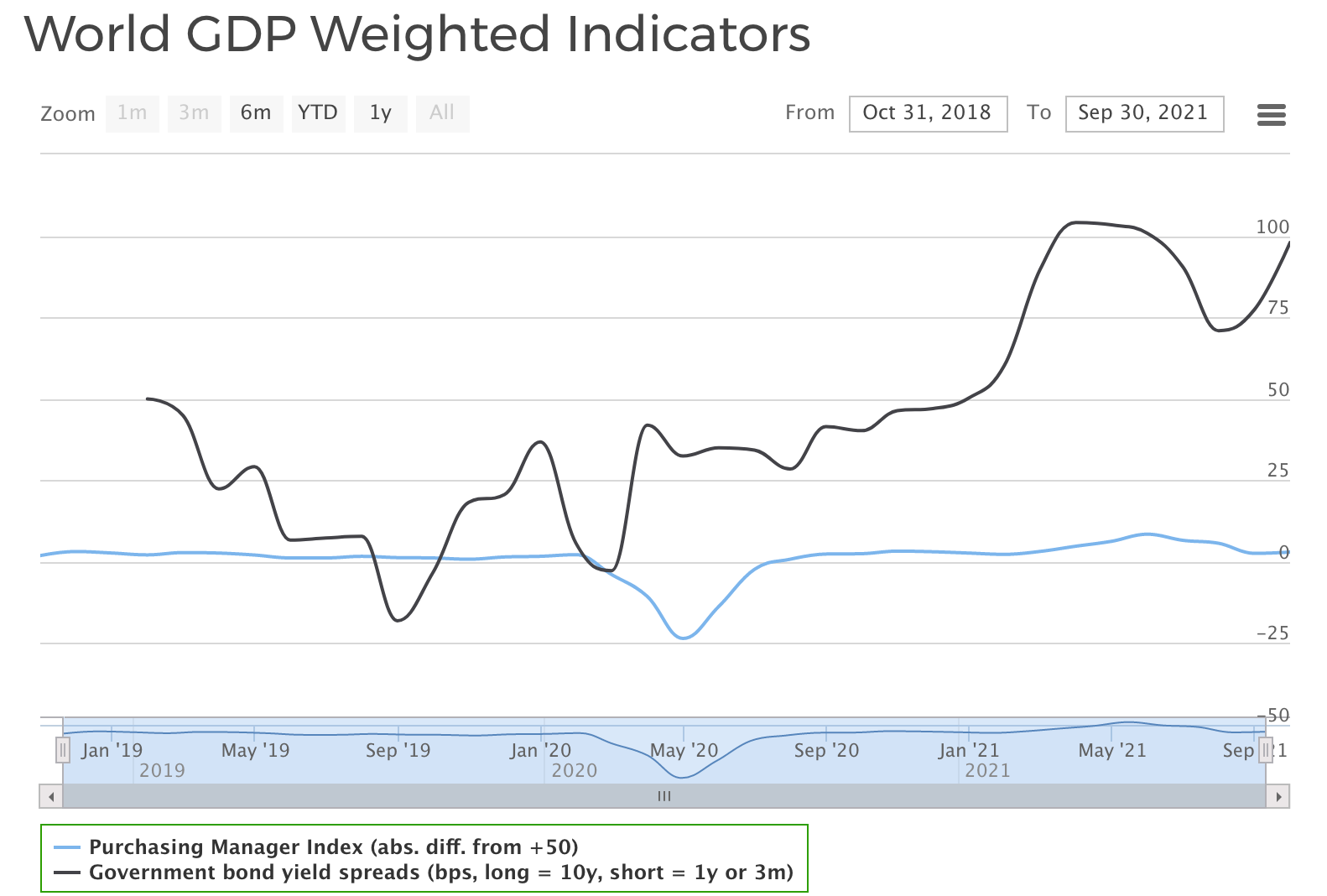

Salkku economic indicators for Q1/2023 are indicating slowing economic growth all over the world. World Composite PMI has remained below 50 for entirety of 2022Q4. US, Eurozone and China are all showing contraction in activity. Moreover, Salkku aggregate index for developed countries government bond yield spreads inverted briefly in November, which indicates that recession in many developed economies is highly likely in 2023.

Read more2022Q2 World economy still going strong

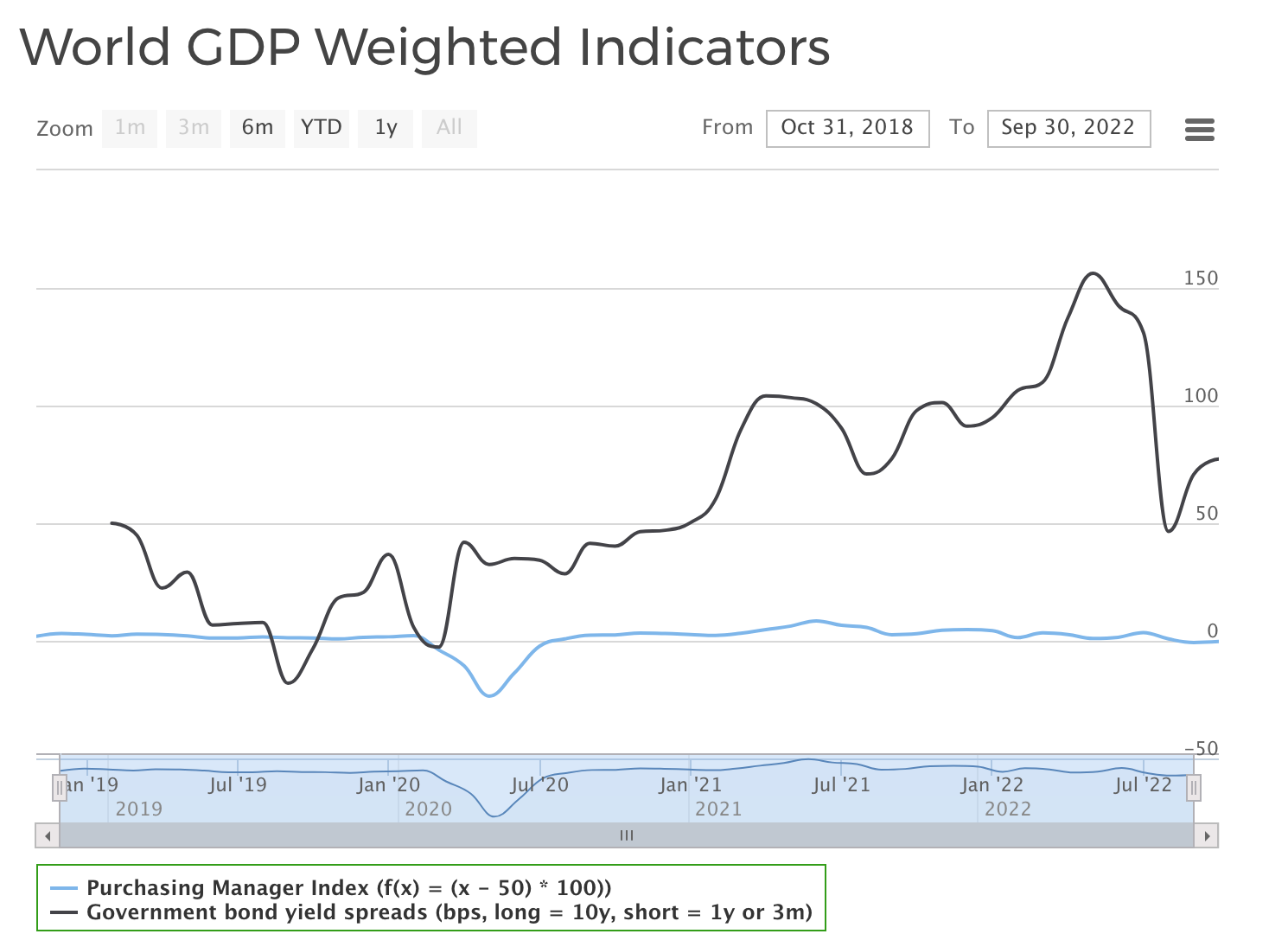

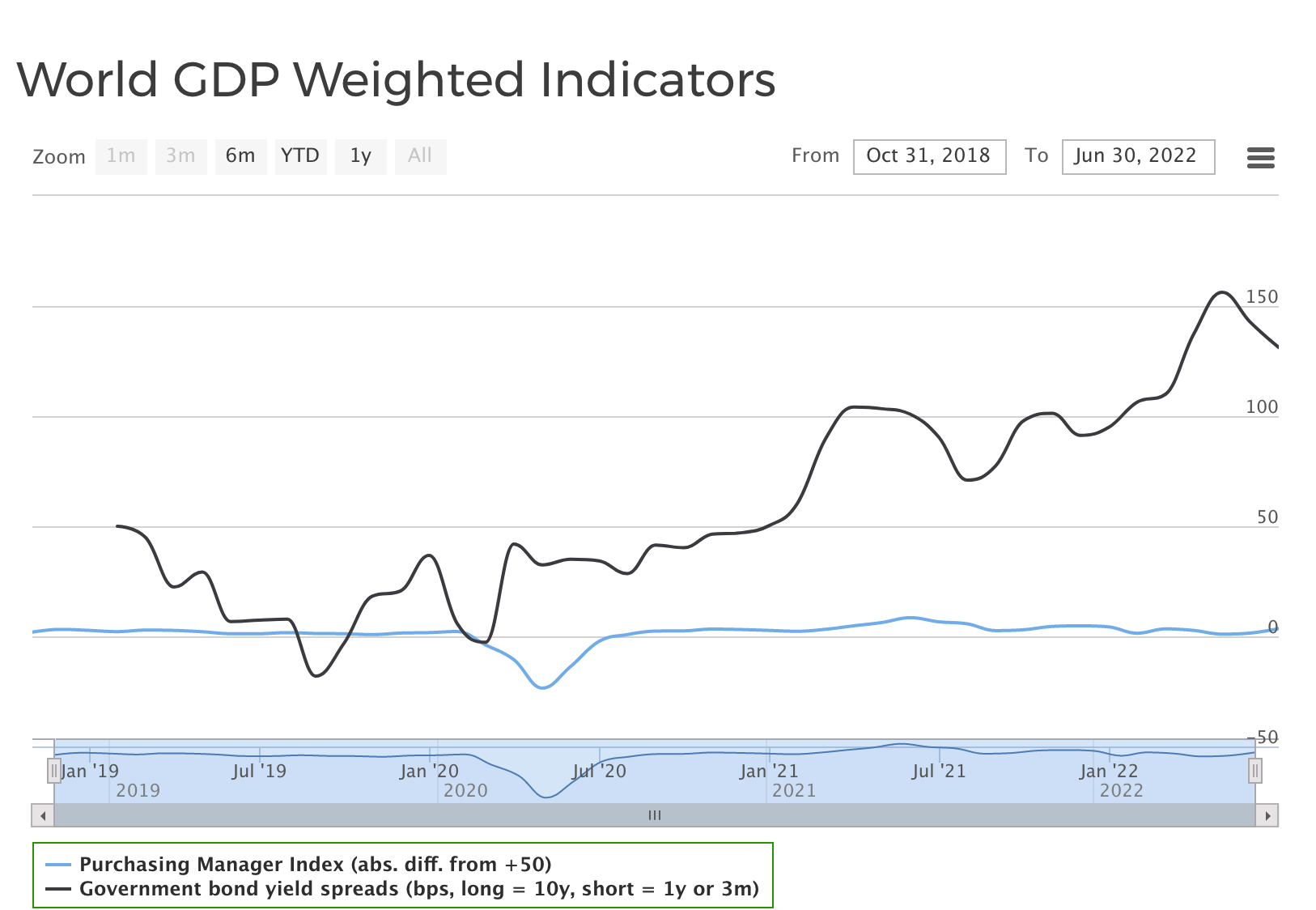

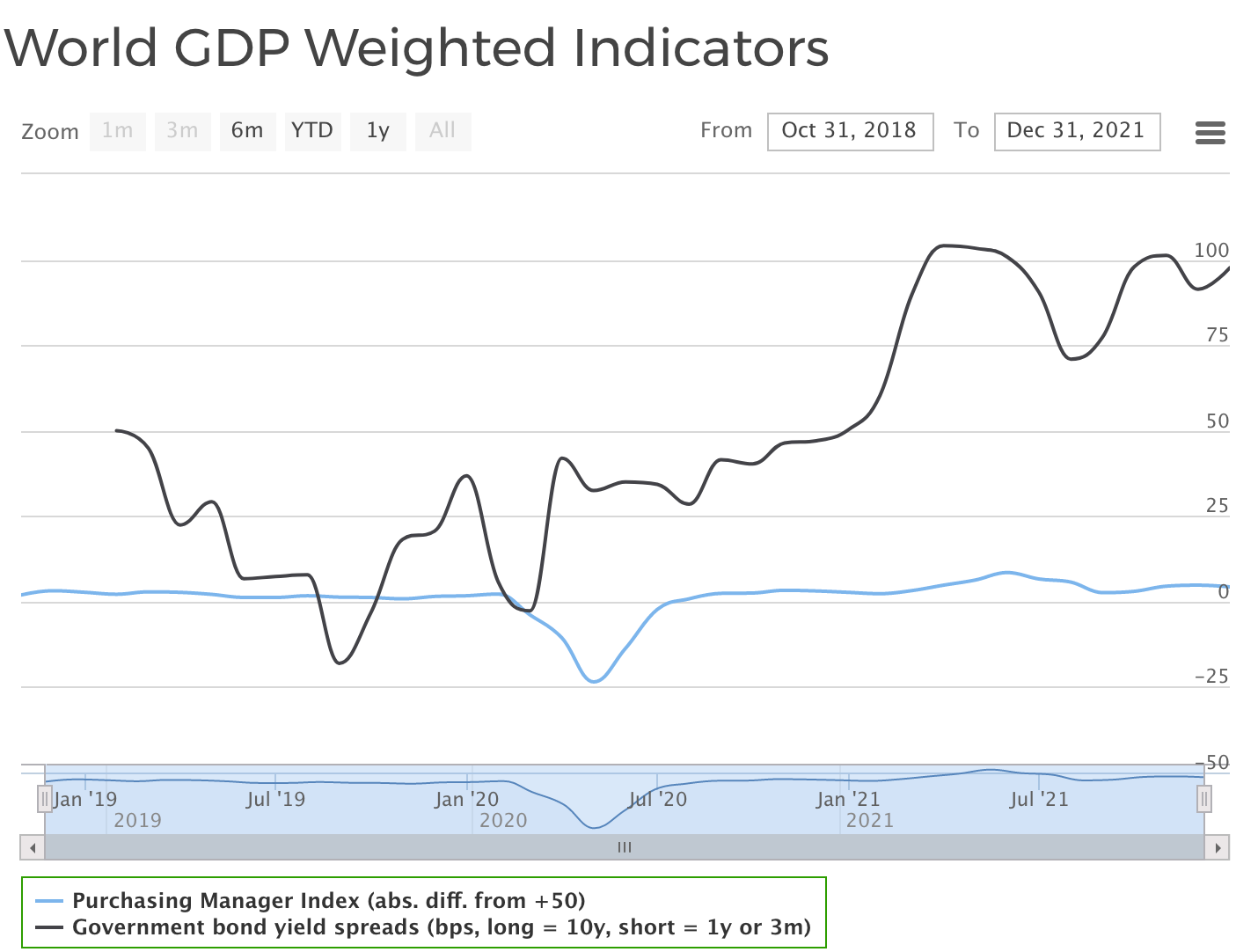

Salkku economic indicators for Q2/2022 are indicating a mostly growing world economy. World Composite PMI is slightly down because of lockdown induced crash in China composite PMI but still over 50 indicating expanding global business outlook. World government bond yield spreads still widened compared to Q1/2022.

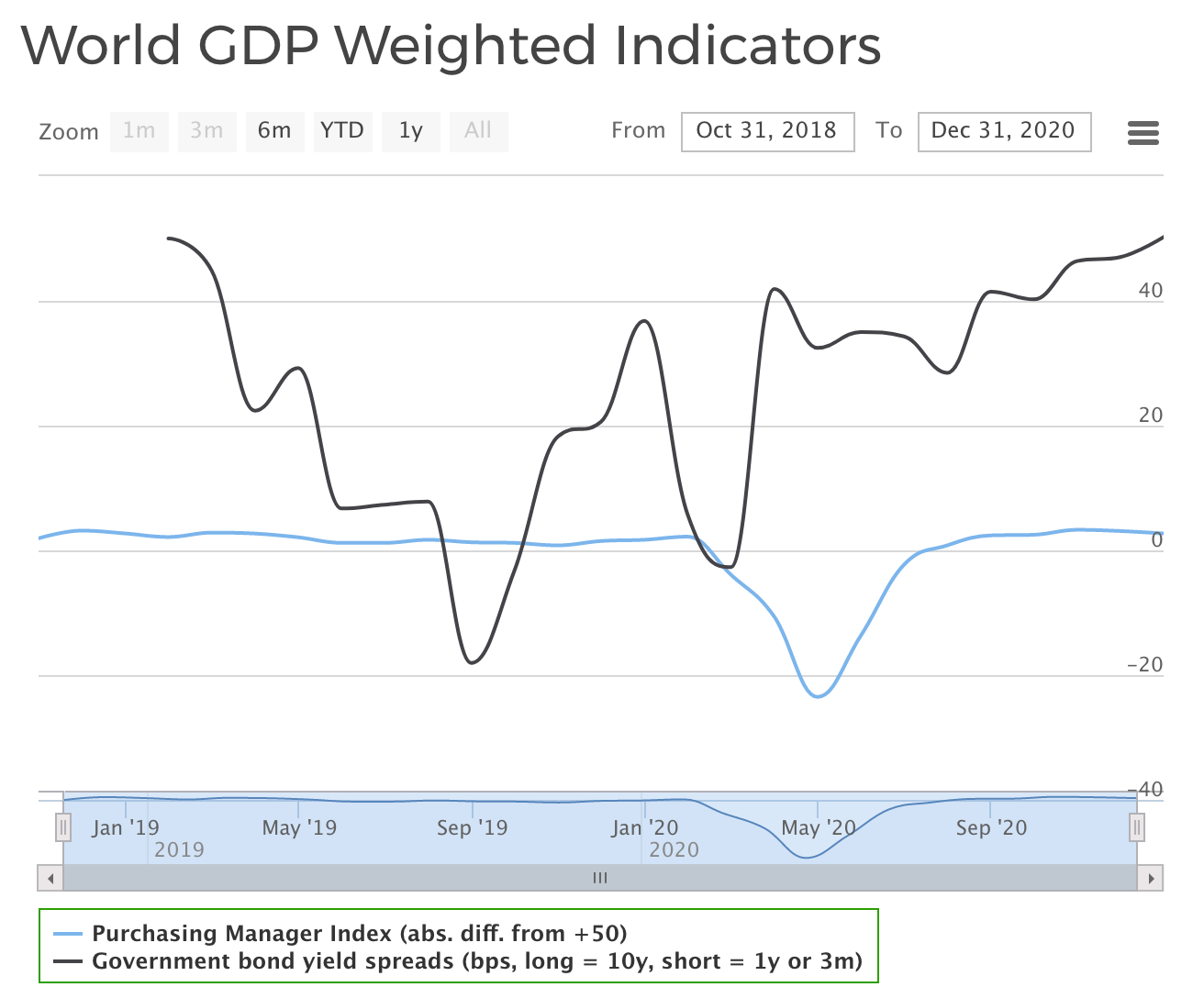

Read more2020Q4 Leading indicators signal expanding world economy

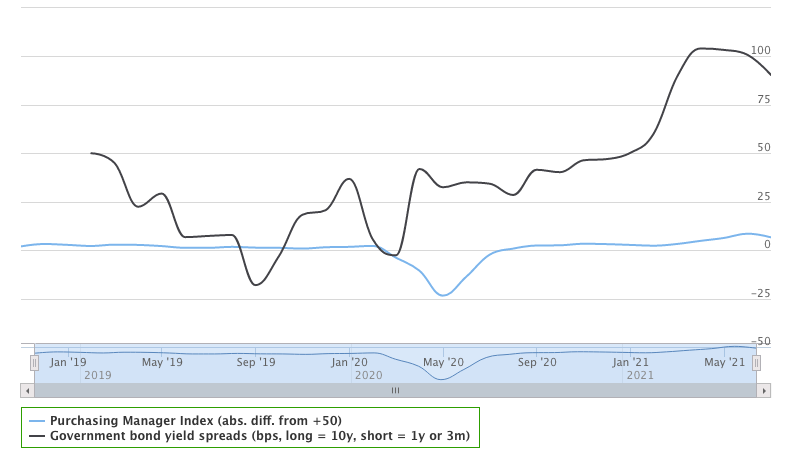

Leading indicators exhibit robust growth for world economy in the final quarter of the year. This quarter is usually a season of strong growth. We’ll see what effect the second wave of coronavirus infections has on economy. By now it should not come as surprise to anyone, and both companies and investors have had ample time to adjust to new set of circumstances. This means that second wave is already fully priced in stock market.

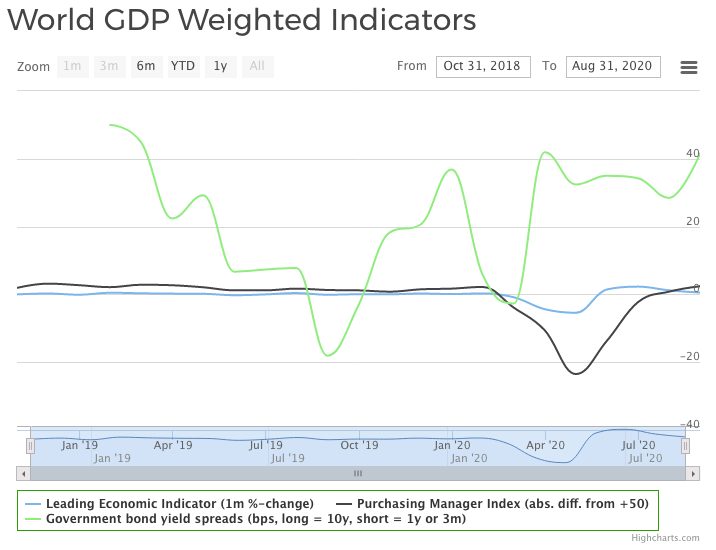

Read more2020Q3 Leading indicators signal bottoming world economy

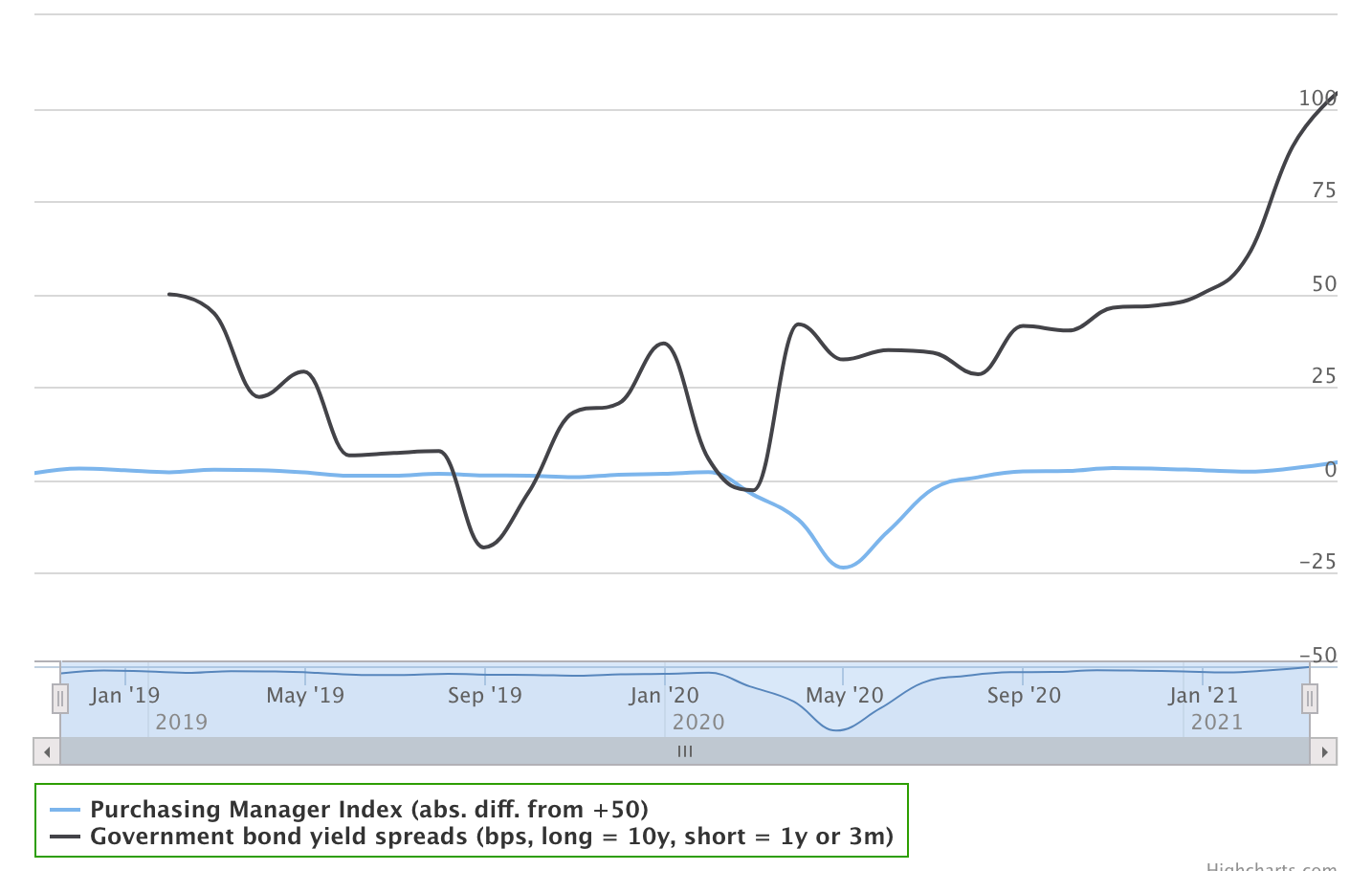

Leading indicators were still shrinking in May. COVID-19 cases were expanding fast, and economies were still largely at lockdown. Lockdowns have since been lifted, but preliminary indicators for June indicated continuing contraction. Only China seems to have been able to grow in June, so Q3 outlook doesn’t look very good. Stock markets have also voiced their view on the matter though, and indicate growing economies in many developed countries, including US and China.

Read more2020Q2 Leading indicators signal shrinking world economy

Onset of global slowdown coincided with coronavirus rendered leading indicators useless, as stock markets took a sharp downturn at the beginning of March. Leading indicators LEI and composite PMI indicated slowing global economy already in February, but those readings came just after market crashed and were of little help for forecasters. Such is the nature of black swans.

Read moreEconomic growth and cryptocurrencies: Case Decentralized Finance

Invention of cryptocurrencies has inspired many people to explore the nature of currency and money itself (including this author). Even more interesting, and less discussed, aspect of economy is how growth is enabled by the same process of money creation. Cryptocurrencies provide us an interesting case study of how economic growth, and wealth creation in general, works. New development in cryptocurrency world called decentralized finance is set to disrupt the old world order.

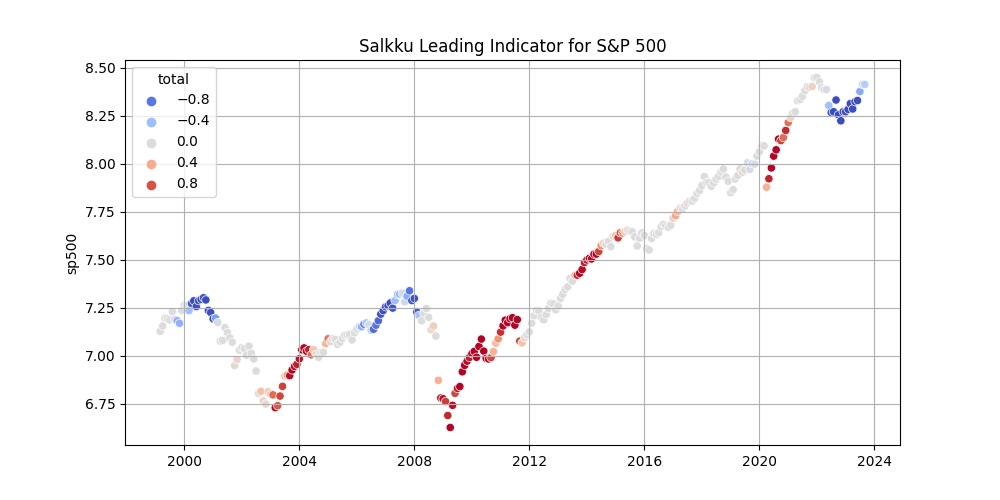

Read moreBetter economic indicators for stock market investors

Stock investors are bombarded by daily headlines about market ups and downs. Along with market developments, media frequently cites various economic indicators to build a narrative about market developments. It’s a good idea to make yourself as an investor aware of most commonly cited economic indicators. Investors would also benefit to make themselves aware of the choices financial publications make when they choose what indicators to report, how to incorporate those numbers to a wider economic narrative, and ultimately to be able to question themselves, do those indicators matter when it comes to investing?

Read more