We expanded our coincident and leading indicators to include world markets, which will be the main focus in these outlooks. Our coincident indicator shows neutral reading for world economy, and leading indicator shows neutral outlook for global stock markets in the next 12 months period. Neutral outlook predicts roughly average stock market returns over one year time horizon.

Coincident economic indicators: PMI

Coincident indicator is an indicator which tells us how the economy is doing right now. We look at changes in Composite Global PMI readings to gauge the development over past few months.

Change in Composite PMI has shown neutral readings in last few months (Figure 1.). This indicates that global business environment in aggregate has not experienced any major shocks, which would impair growth.

History of PMI indicator

| Month | 2023-10-31 | 2023-11-30 | 2023-12-31 | 2024-01-31 | 2024-02-29 |

|---|---|---|---|---|---|

| Signal | Negative | Negative | Neutral | Neutral | Neutral |

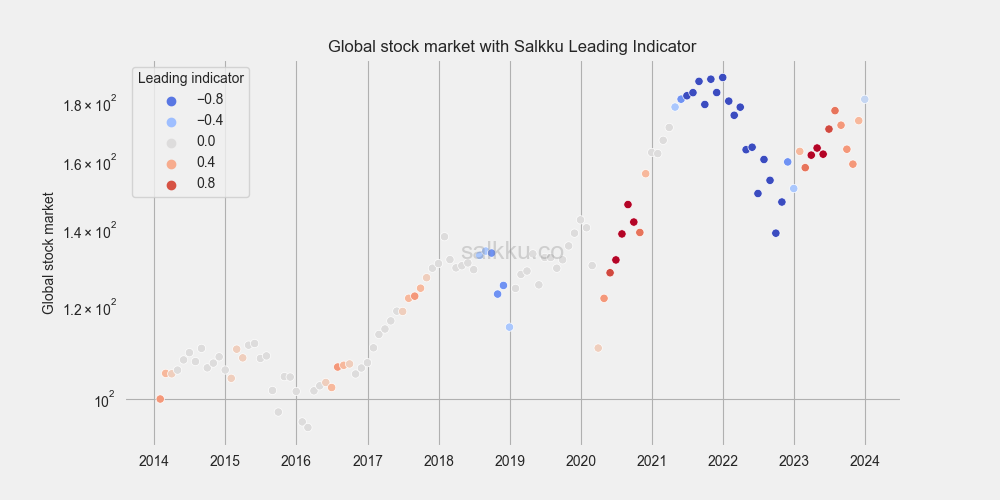

Leading economic indicators: Salkku Composite

Our leading indicator for global markets is a collection of individual indicators, which has in the past best predicted global market growth in 12 month period. Currently we are including inflation data, and central bank balance sheets as proxy for liquidity in our leading indicator.

Our composite leading indicator for global stock markets indicate cooling outlook over the next 12 month period after very strong readings at the end of 2023. This year, leading indicator turned slightly negative, until bouncing back to neutral value. This indicates that 2024 markets returns should be ok or slightly above normal.

History of leading indicator

| Month | 2023-10-31 | 2023-11-30 | 2023-12-31 | 2024-01-31 | 2024-02-29 |

|---|---|---|---|---|---|

| Signal | Positive | Positive | Negative | Negative | Neutral |

Conclusion

Our indicators show neutral market condition, and predict neutral market returns over 12 month period. Slightly higher inflation readings in developed countries haven’t spooked markets, and absent sudden shocks, stock market returns should be ok or slightly above normal.