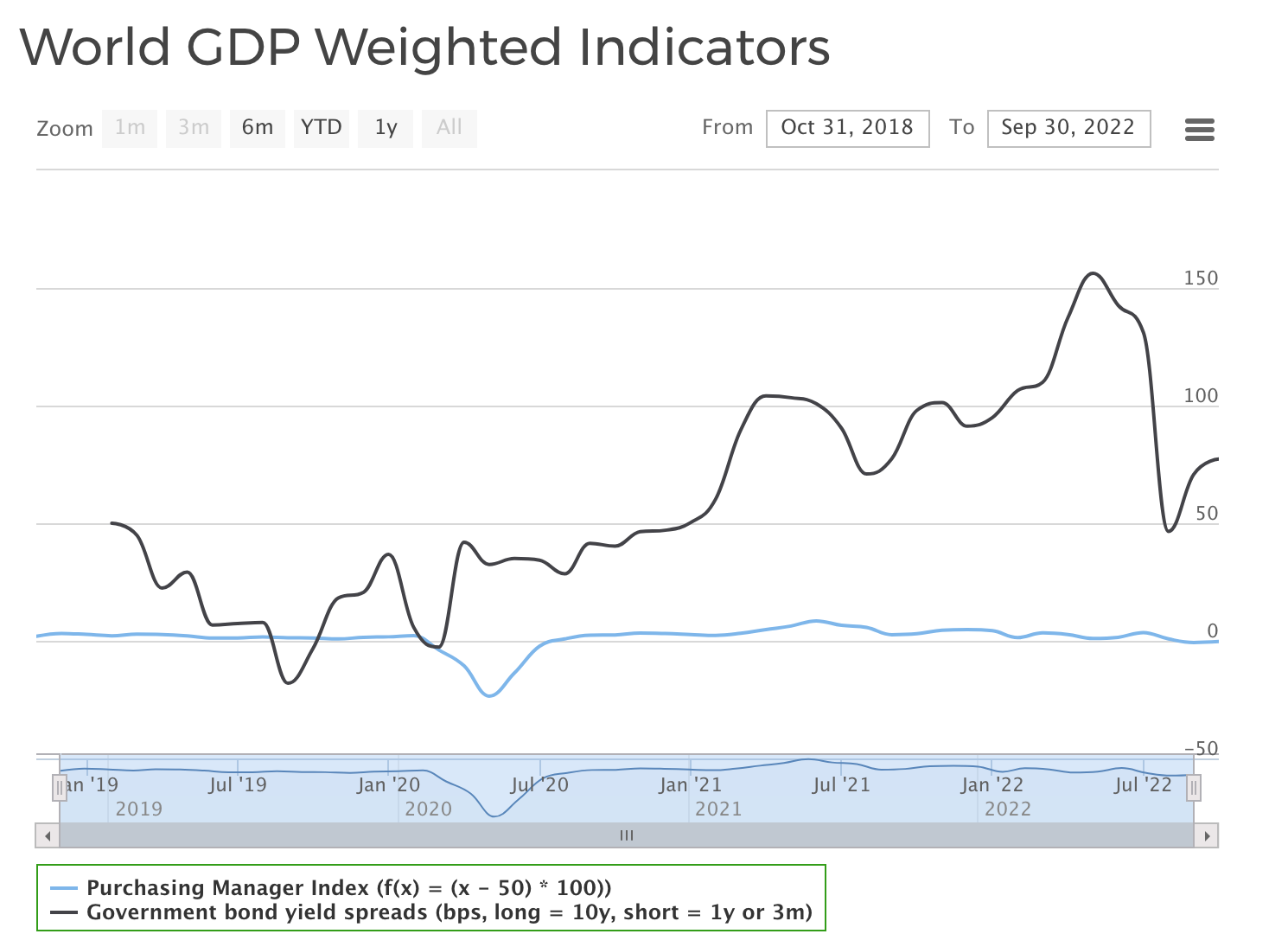

Salkku economic indicators for Q4/2022 are showing mixed signals. World Composite PMI has contracted significantly during summer months and world government bond yield spreads have tightened a bit during summer, but are still overall positive.

Mixed signals with indicators

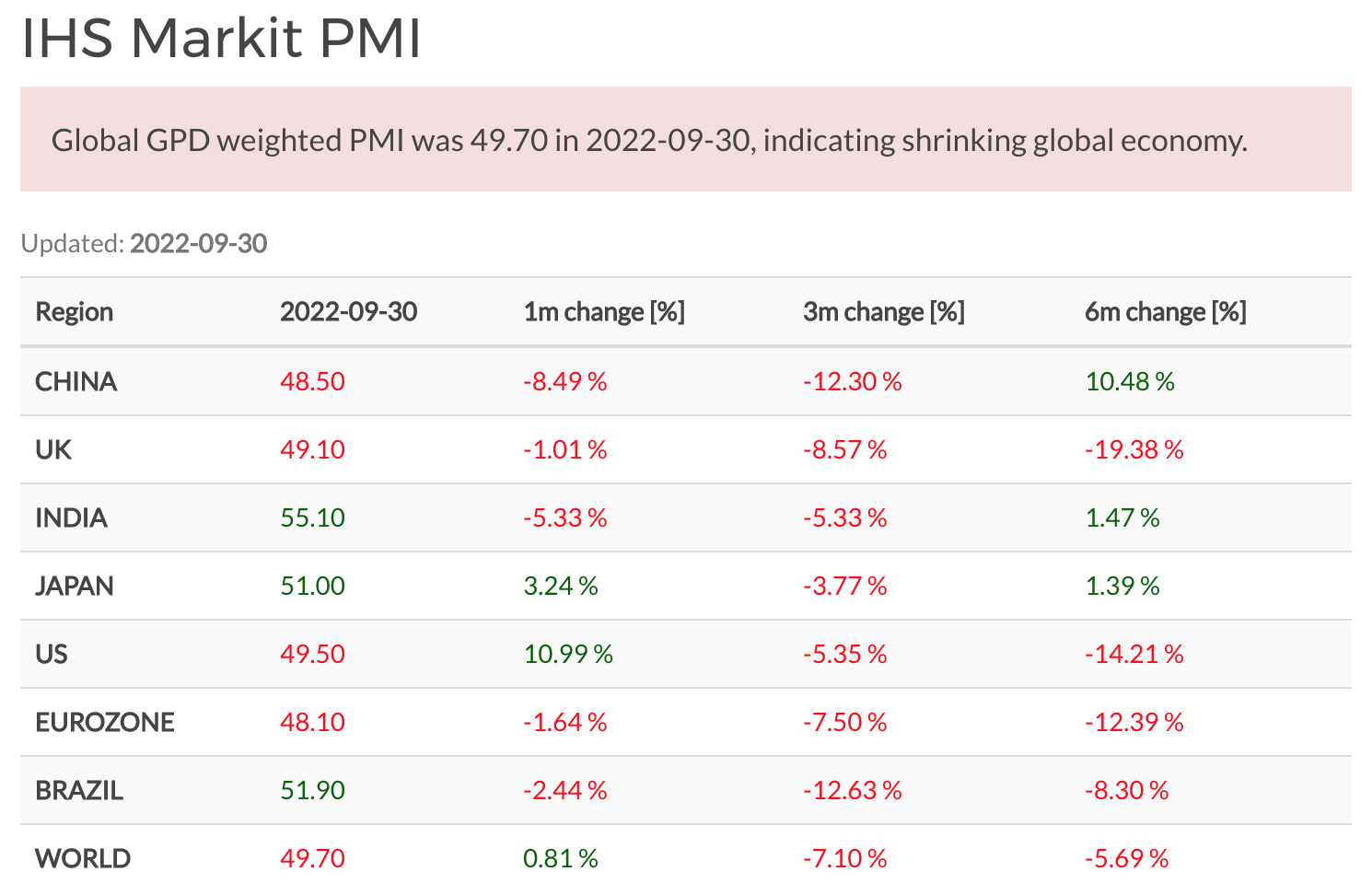

World Composite PMI was 49.7 at the end of September, which is overall showing signs of cooling economy in aggregate. India, Brazil and Japan still have readings over 50, rest of the countries being tracked are under 50.

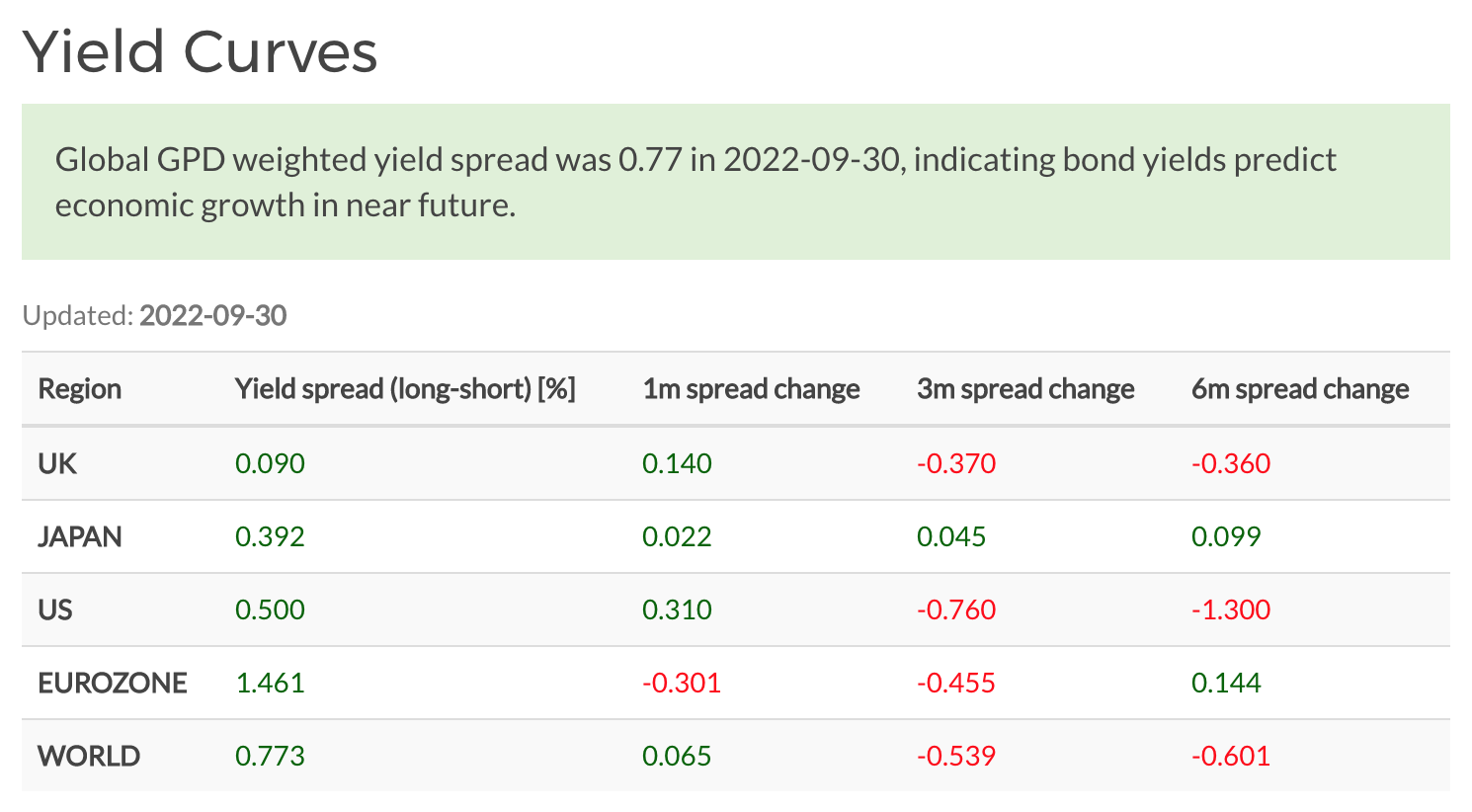

Yield spreads have tightened significantly during summer months. Even aggregate world yield curve inversion was on the cards at the end of July. Since then rates have been rising more quickly on the long end of the curve so that was avoided.

Thoughts on Q4/2022

PMI levels are indicating weakness across the globe. Rising loan rates, inflation and significant drawdown on central bank liquidity are having a cooling effect on economic activity in developed economies. China has still major problems with Covid-19 restrictions and housing bubble. World stock markets have not staged any significant rebound yet, with index levels forming double bottom in many markets.

With yield spreads still being on healthy levels, it seems that bond markets are not yet worried enough to post a global recession signal. Signs of significant global economic contraction are still not visible despite the weakness in markets. Rather what can be inferred from indicators is that some, not all, economies might experience a brief recession.