The Salkku Markets Outlook for Q4 2025 adopts a neutral stance for global stock markets over the next 12 months, underpinned by a rebound in the Salkku Coincident Indicator and a neutral reading from the Salkku Leading Indicator.

Executive Summary

The Coincident Indicator posted its first positive reading since April 2025 at 1.4 in August, signaling an improving global business environment. The Leading Indicator, at 0.0, suggests market returns will align with historical averages. A machine learning model based on leading indicator components forecasts positive returns with a 72% probability, supported by seasonal strength extending into 2026. Complementary indicators, such as the OECD Composite Leading Indicator and consumer confidence indices, reinforce this cautiously optimistic view. However, risks from geopolitical tensions, monetary policy shifts, and supply chain constraints require ongoing vigilance.

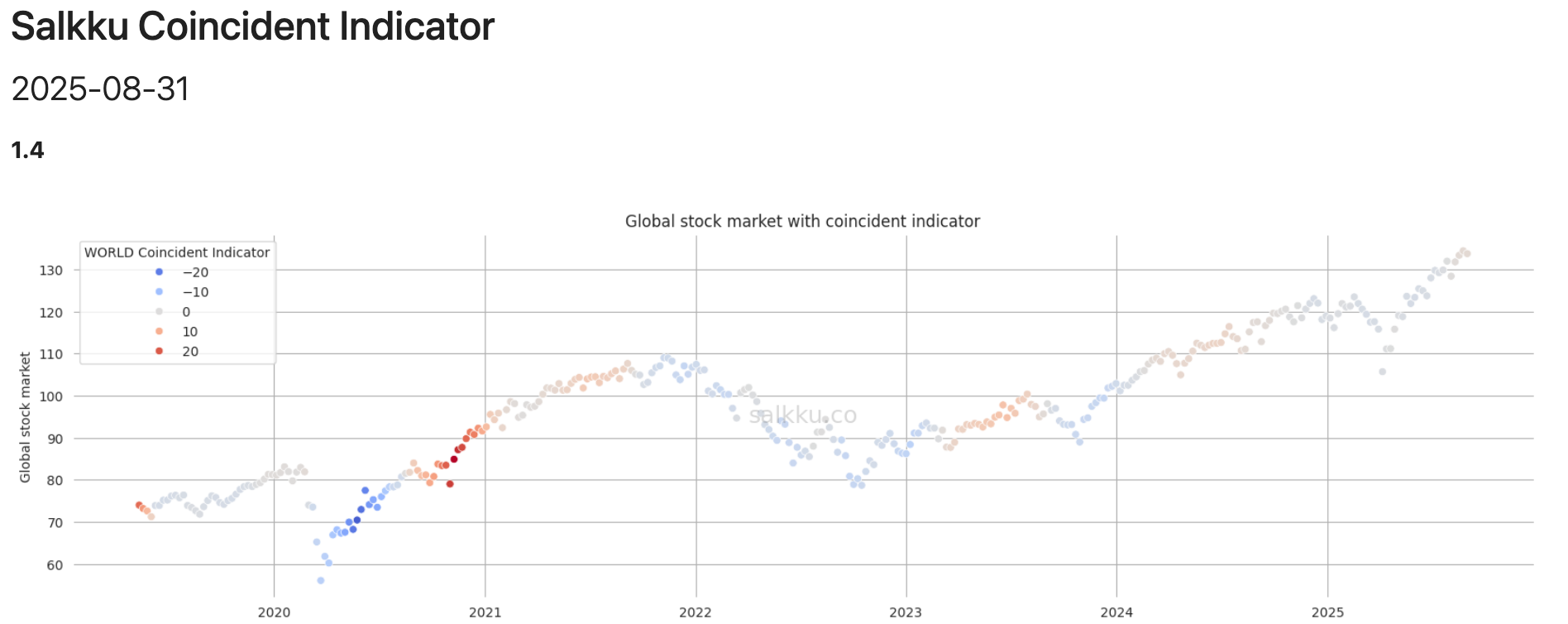

Salkku Coincident Indicator for Global Markets

The Salkku Coincident Indicator tracks the current state of the global economy, primarily through the Composite Global Purchasing Managers’ Index (PMI), which measures business activity in manufacturing and services sectors.

As of August 31, 2025, the Salkku Coincident Indicator recorded a positive reading of 1.4, its first expansionary signal since April 2025. This uptick reflects a strengthening global business environment since the summer, driven by resilient service sector activity and recovering industrial output. The improvement aligns with broader coincident indicators, such as rising global industrial production and stable employment metrics in key economies like the U.S. and Eurozone.

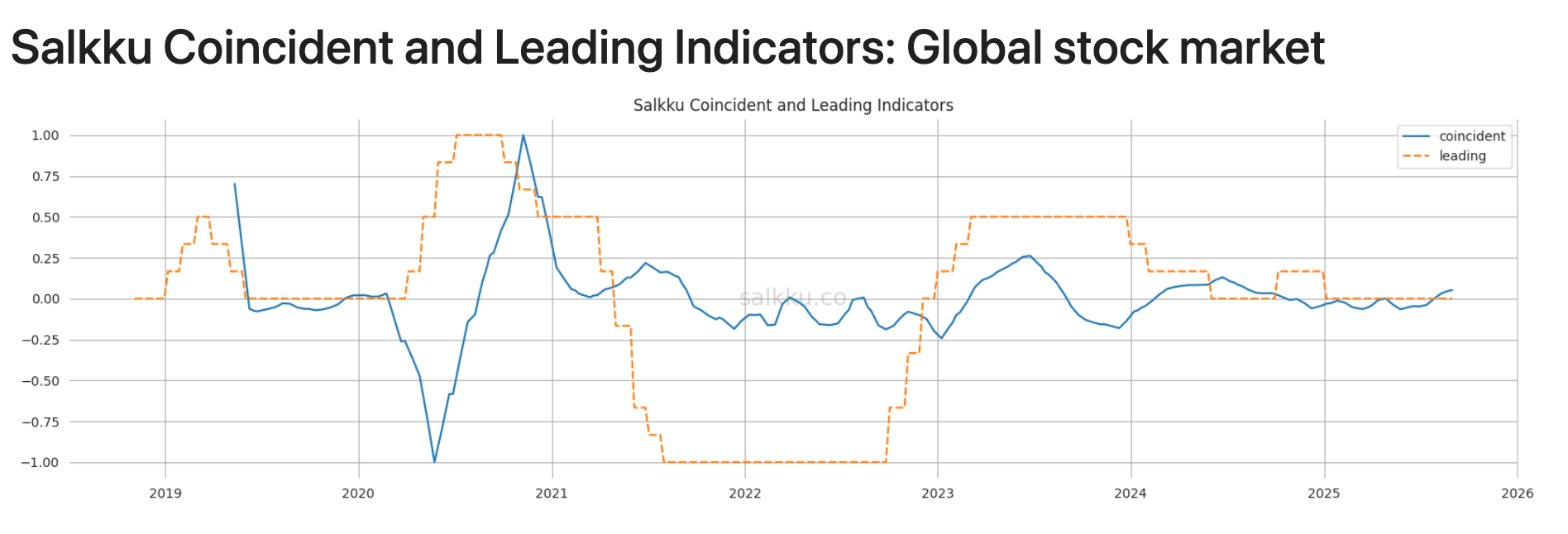

Salkku Leading Indicator for Global Markets

The Salkku Leading Indicator aggregates forward-looking metrics, including economic sentiment, manufacturing orders, and financial market signals, to predict global stock market performance over a 12-month horizon.

In September 2025, the Salkku Leading Indicator registered a neutral reading of 0.0, indicating that global stock market returns are expected to match long-term averages over the next 12 months.

Regional Outlook for Global Stock Markets

To provide a comprehensive view, the following section outlines the 12-month outlook for key regional stock markets, incorporating regional economic trends, leading indicators, and potential risks.

North America

- Outlook: Moderately Positive

- Key Drivers: The U.S., the dominant market in North America, benefits from robust consumer spending and strong corporate earnings, particularly in technology and healthcare sectors. The Conference Board Consumer Confidence Index has trended upward in 2025, supporting equity market resilience. The Federal Reserve’s anticipated gradual rate adjustments provide a stable monetary backdrop, though inflation risks persist.

- Market: The S&P 500 surged to record highs in Q3, fueled by the AI boom and the Fed’s 25 bps rate cut in September. Small-cap stocks also rallied (+8.6%), reflecting optimism around policy easing and resilient U.S. economic data, though consumer defensives lagged.

See detailed Salkku Indicators for United States.

Europe

- Outlook: Neutral

- Key Drivers: European markets, particularly in the Eurozone, are supported by improving industrial production and export activity, as reflected in the Eurozone PMI rising above 50 in mid-2025. ECB’s cautious monetary easing fosters a stable environment for equities, particularly in defensive sectors like utilities and consumer staples.

- Market: European markets underperformed globally, with the MSCI Europe ex-UK index lagging due to tariff uncertainties and slower regional growth. Germany’s DAX saw modest gains from export-heavy firms but faced headwinds from U.S. policy shifts and geopolitical risks.

See detailed Salkku Indicators for Eurozone.

Asia-Pacific

- Outlook: Positive

- Key Drivers: China’s stimulus measures in 2025, including infrastructure spending, support regional growth, particularly in emerging markets. Japan’s equity markets benefit from stable corporate governance reforms and a weaker yen, boosting export-driven sectors. India’s strong GDP growth and rising foreign investment inflows bolster its market outlook.

- Market: Asia ex-Japan led major regions, propelled by a sharp rally in Chinese tech stocks (Hang Seng Tech +22.1%). Chinese stocks are signaling a growing optimism especially towards Chinese tech performance in the near future, supported by strong investments in AI. Stimulus measures and subsiding U.S.-China trade frictions lifted sentiment, with the Shanghai Composite gaining on policy support and strong year-to-date momentum (+46% for tech).

Emerging Markets (Ex-Asia)

- Outlook: Neutral

- Key Drivers: Latin American and African markets are supported by commodity price stability, particularly in energy and metals, benefiting countries like Brazil and South Africa. Improving global trade dynamics enhance export-oriented economies.

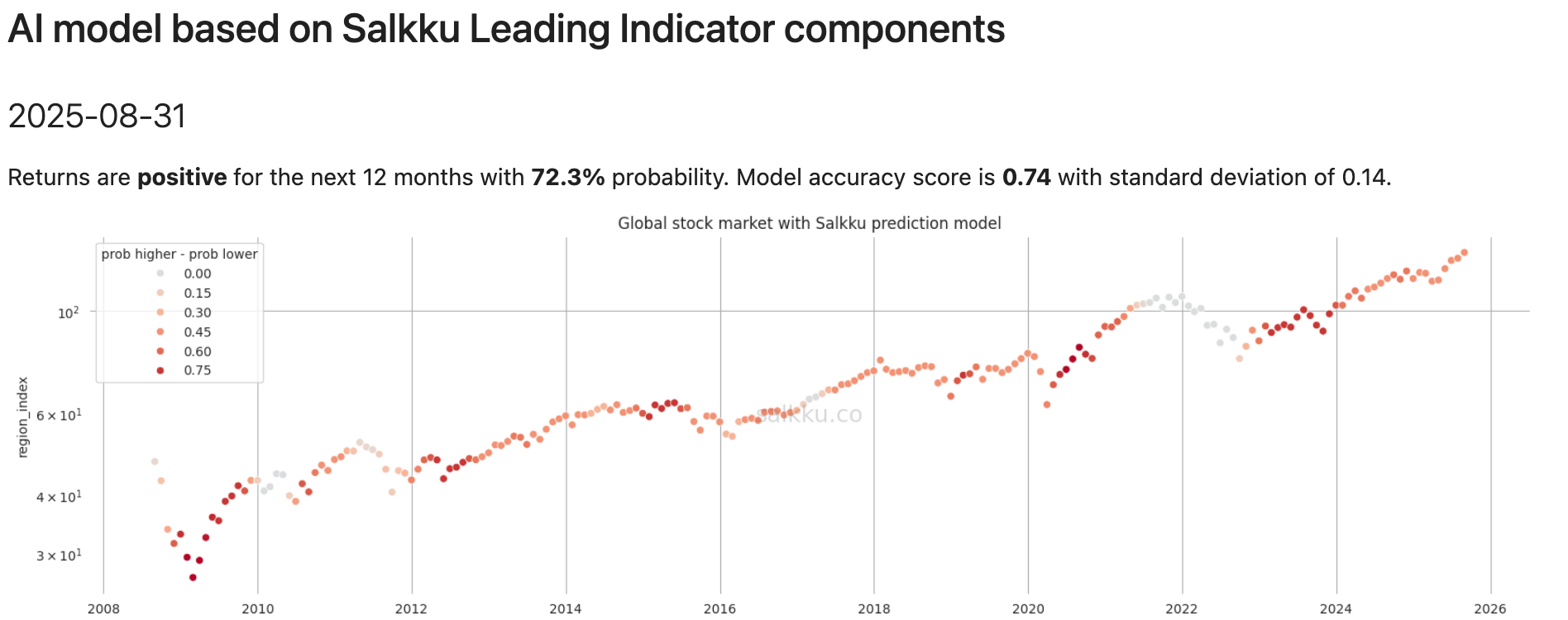

Model Prediction

The global market outlook has improved steadily since spring 2025, with the Salkku machine learning model forecasting positive stock market returns over the next 12 months with a 72% probability. This prediction incorporates leading indicator components, including global equity valuations, corporate earnings forecasts, and macroeconomic trends.

Conclusion

The Salkku Markets Outlook for Q4 2025 maintains a neutral stance, reflecting balanced prospects for global stock markets. The positive Coincident Indicator and neutral Leading Indicator, combined with a cautiously optimistic machine learning forecast, suggest moderate growth potential through 2026.

Historical seasonal strength in Q4 and early Q1 supports the model’s optimism. We have also witnessed rising consumer confidence in major markets, such as the U.S. Conference Board Consumer Confidence Index, and increased willingness of governments to support markets with state spending. We expect inflation to remain subdued for the time being, giving central banks room to ease rates as needed.