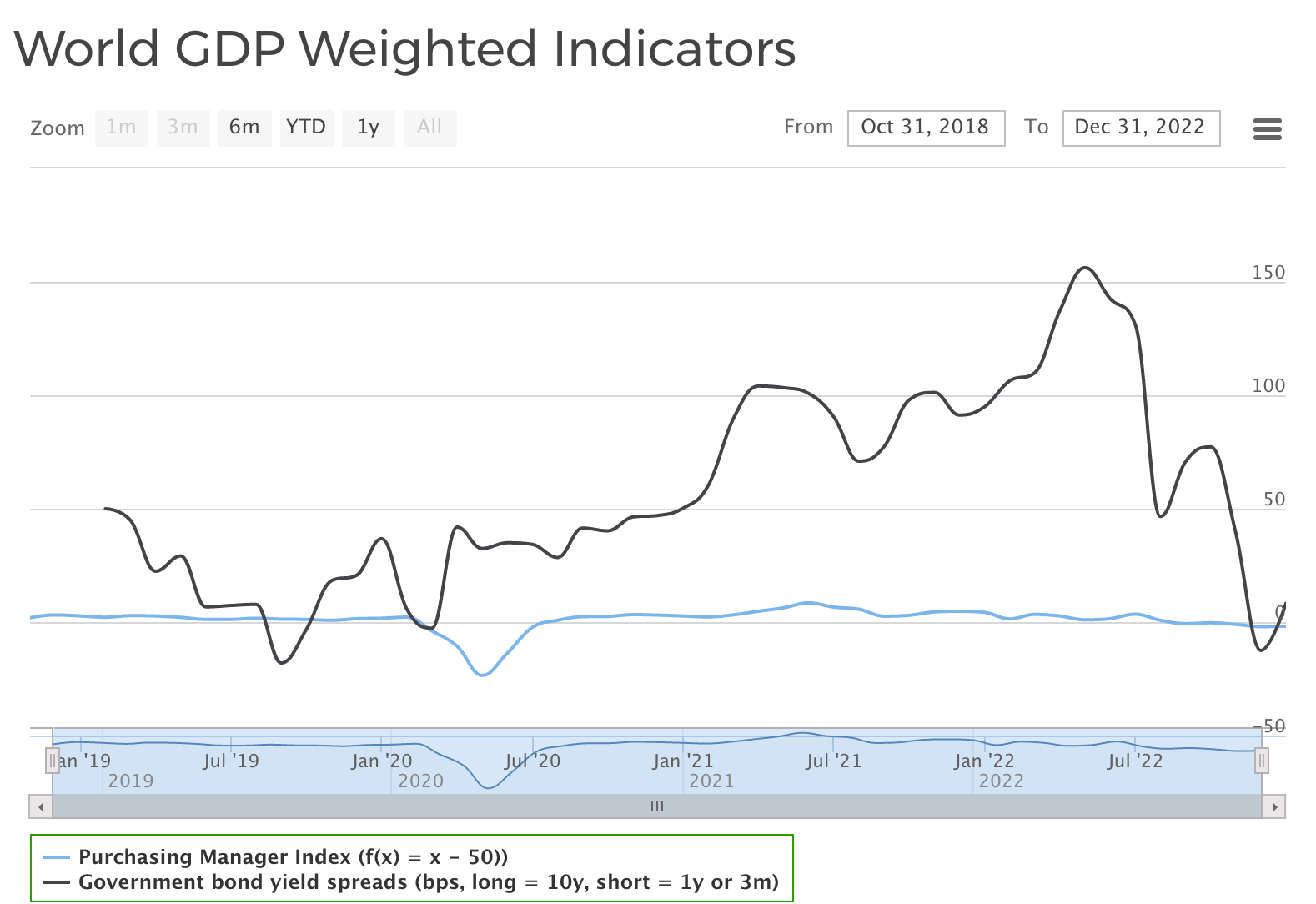

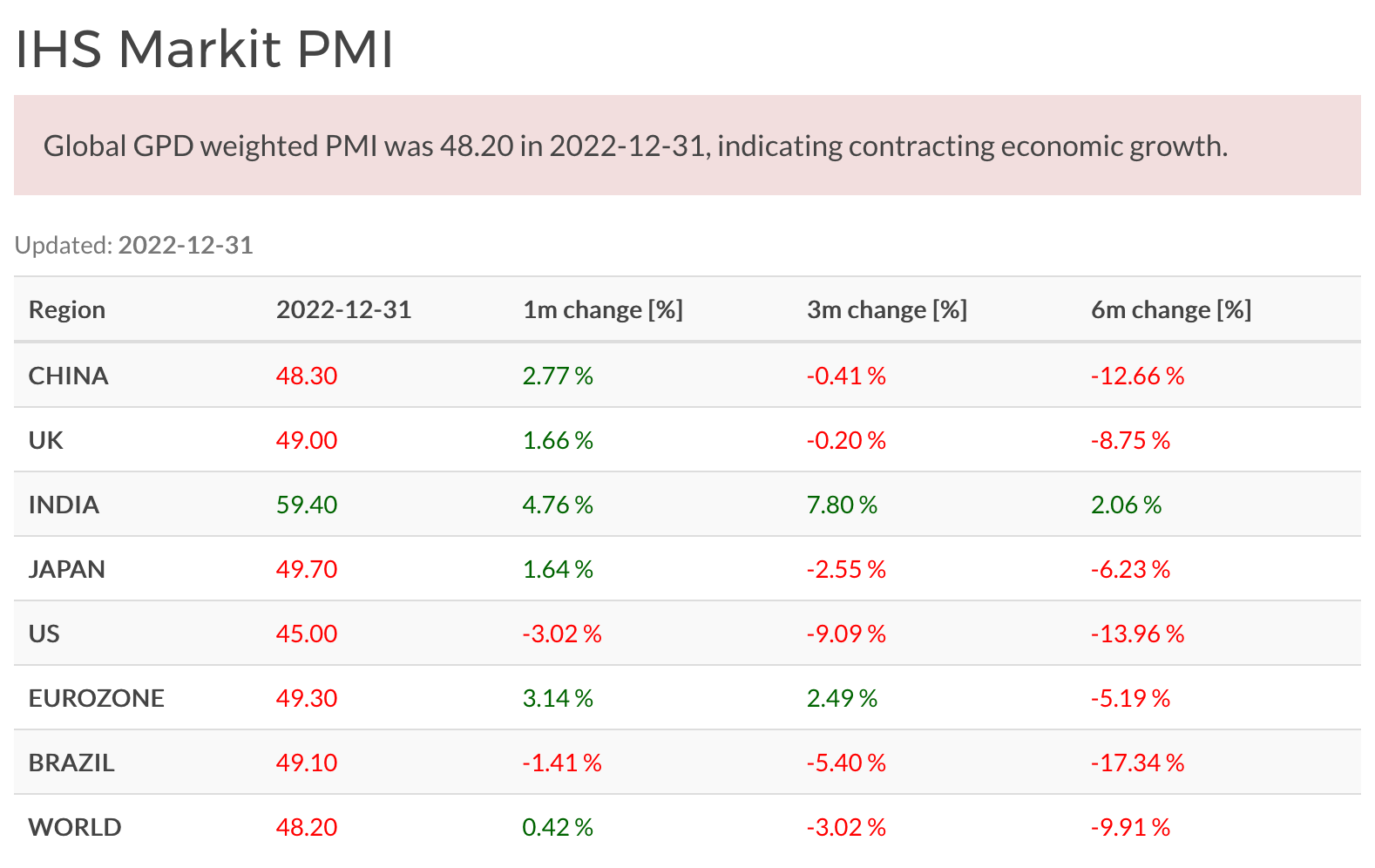

Salkku economic indicators for Q1/2023 are indicating slowing economic growth all over the world. World Composite PMI has remained below 50 for entirety of 2022Q4. US, Eurozone and China are all showing contraction in activity. Moreover, Salkku aggregate index for developed countries government bond yield spreads inverted briefly in November, which indicates that recession in many developed economies is highly likely in 2023.

PMI weak, yield curve inverted

World Composite PMI was 48.2 in December, a value which is overall showing signs of cooling economy in aggregate. Sole bright spot is India, with very strong PMI.

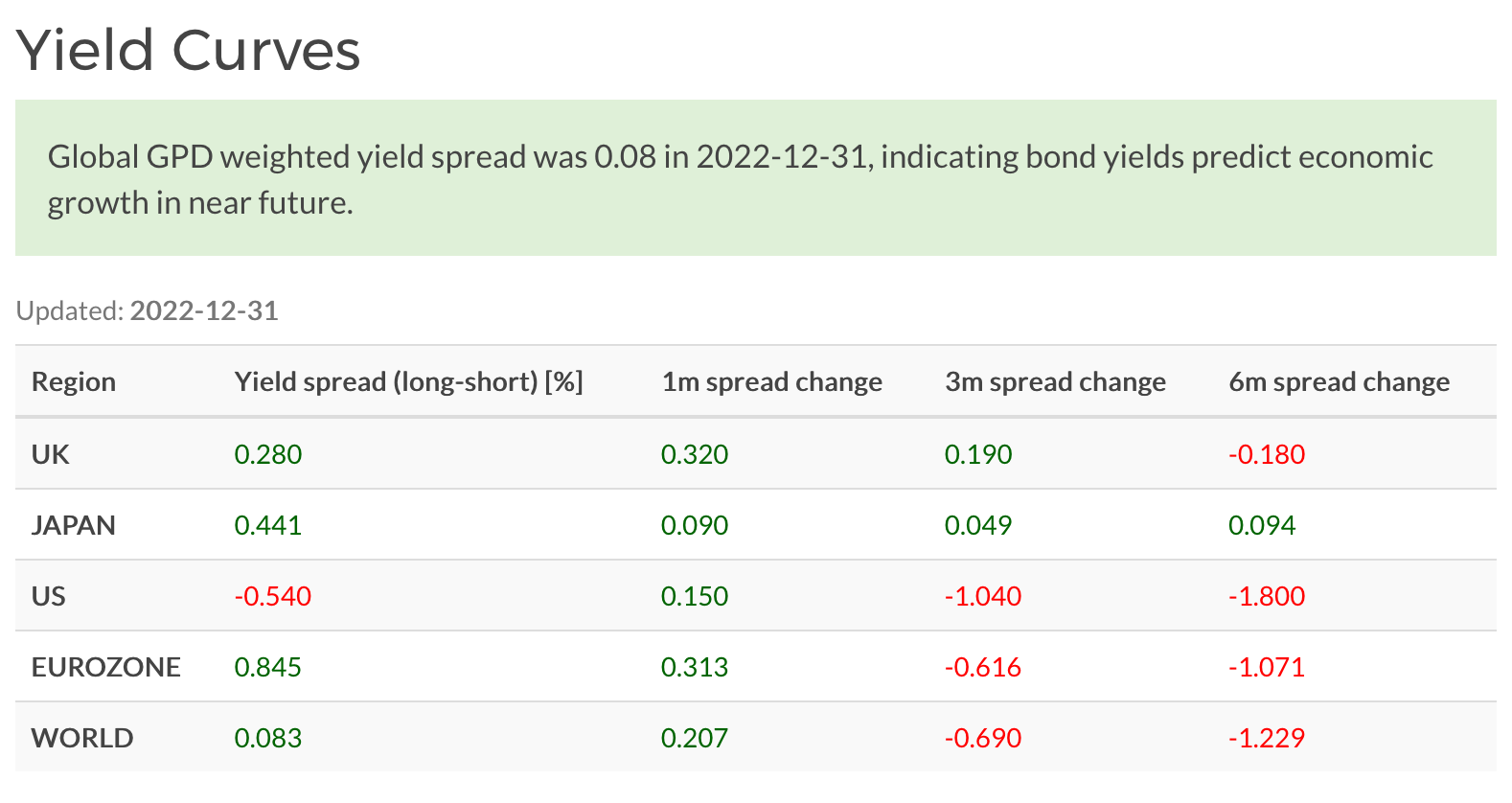

On the bond market, US yield spread between long and short duration gov bonds is very negative. Aggregate yield curve for major developed economies also inverted briefly in November. OTOH, Eurozone, UK and Japan yield curves suddenly steepened in December. Bond markets there don’t seem to signal such a dire worry as in the US. It’s as if the Euro economy is showing unexpected signs of strength, despite significant headwinds from energy and inflation.

Thoughts on Q1/2023

We start the year with much weaker outlook than in 2022. Economic weakness has become apparent in developed world since beginning of 2022, when stock markets started to price growth slowing significantly.

While I wrote in last outlook, “it seems that bond markets are not yet worried enough to post a global recession signal”, this time the signal is more clear. 2023 growth is slowing, and we’ll probably see recession in the near future in some/most of developed economies. Situation now is somewhat similar as at the beginning of 2020, when yield curve inverted. Would COVID-19 not have stricken the world, we would probably have seen a moderate recession anyway. However, stock markets took a major hit only after pandemic hit the news. Absense such a catalyst now, it it likely that stock markets have already priced in the slowing economy and moderating earnings, and we might see a positive year in the markets.