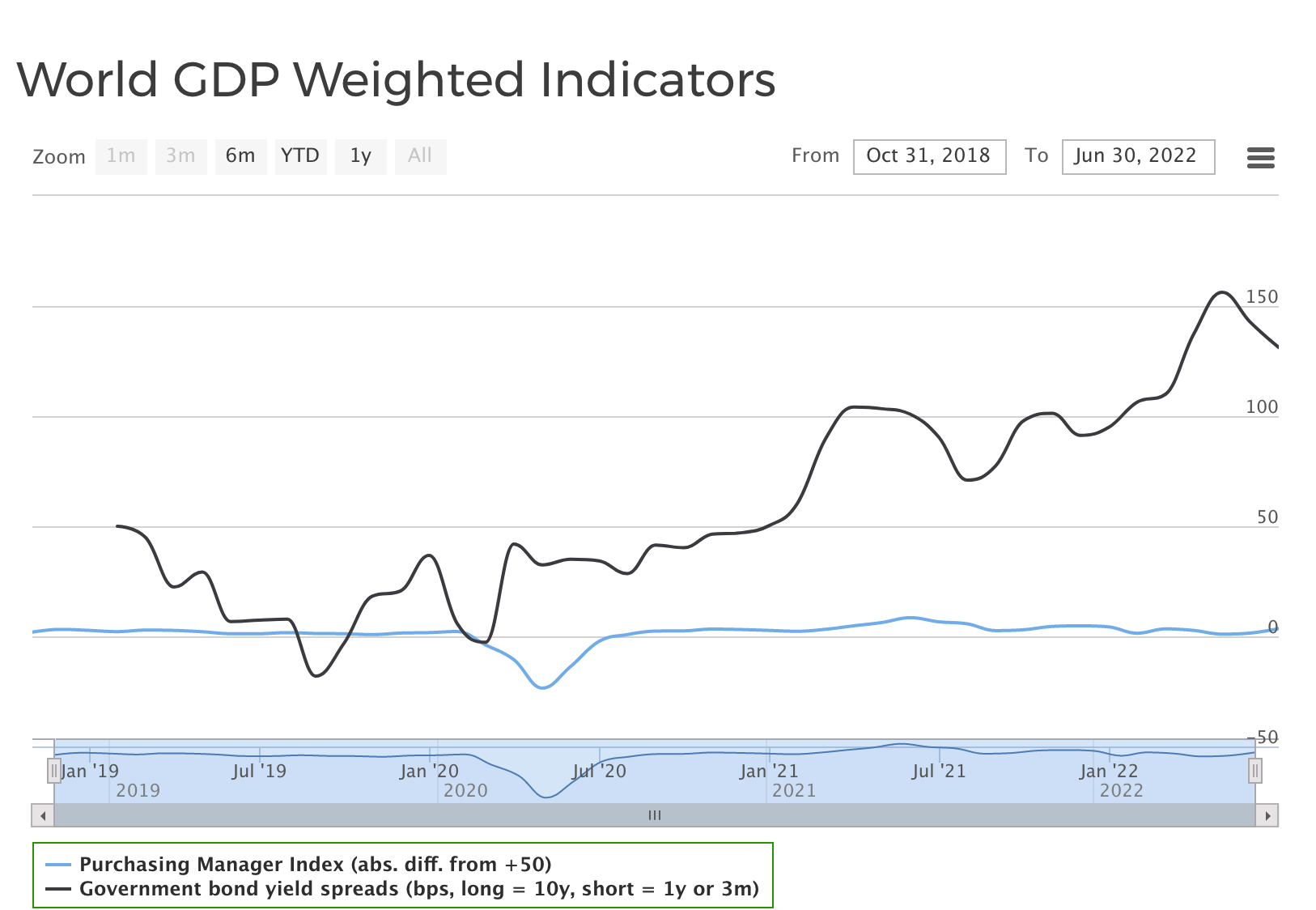

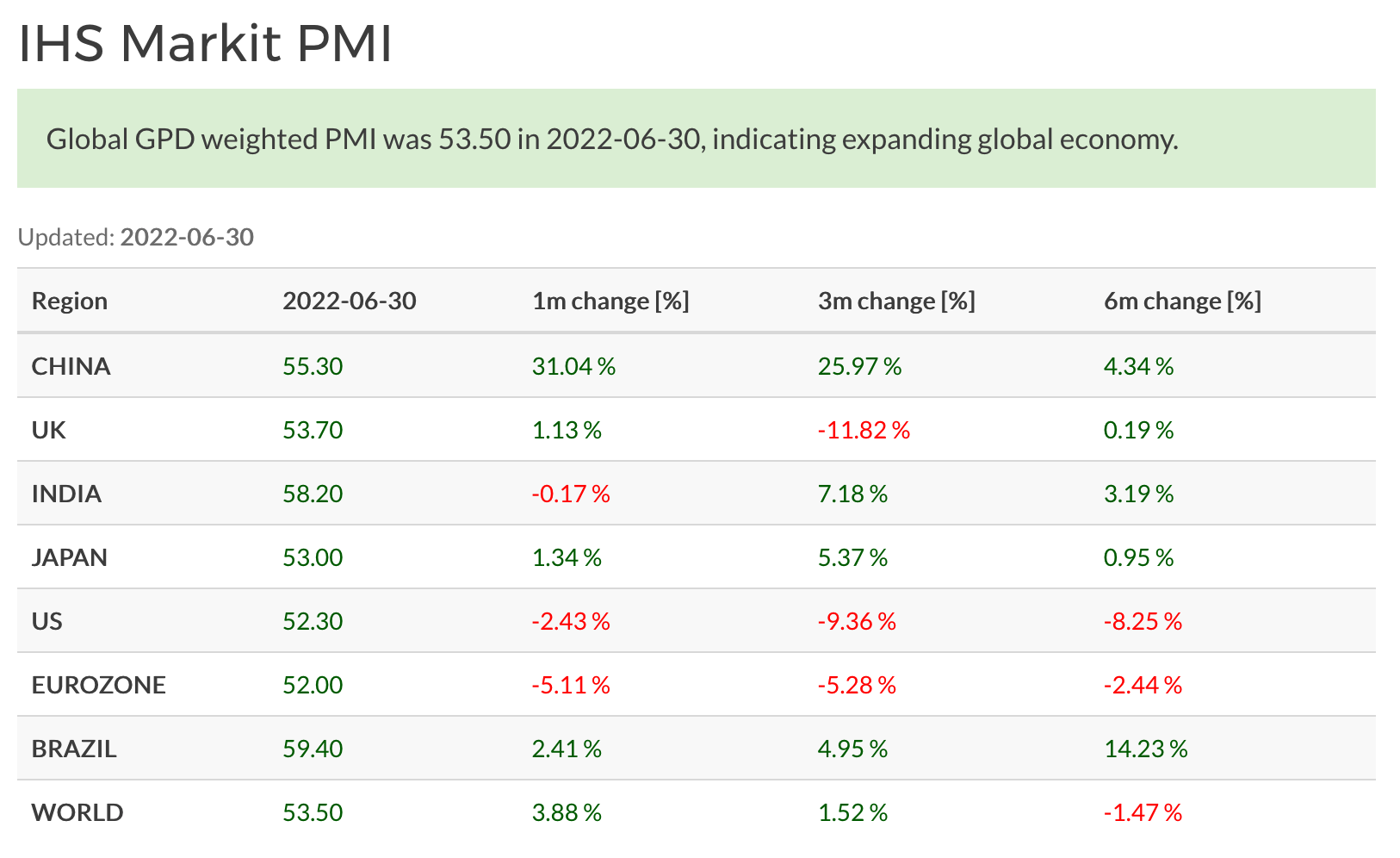

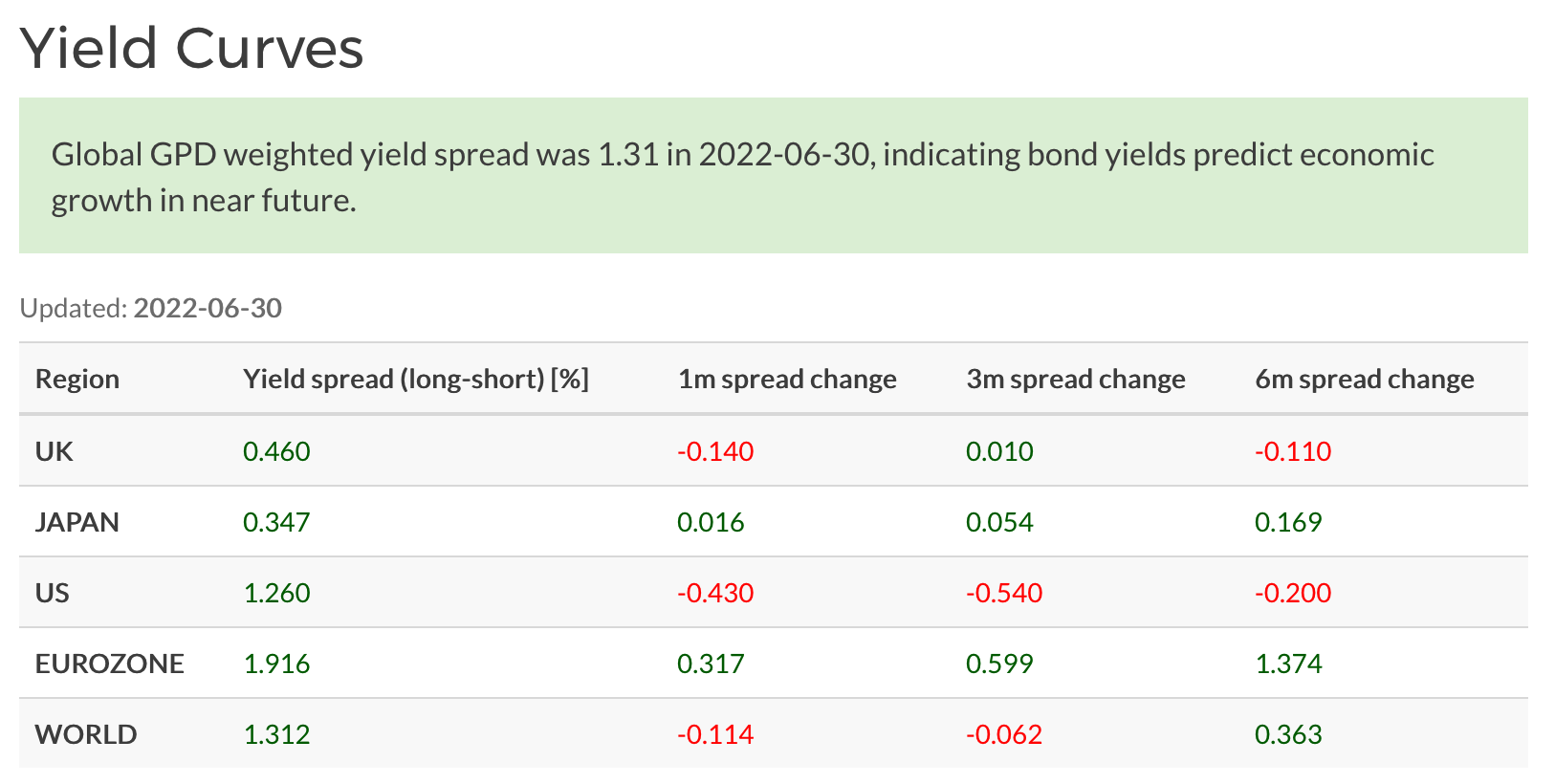

Salkku economic indicators for Q3/2022 are indicating solidly growing world economy. World Composite PMI is up on one and three month timescales and all regions are showing numbers above 50. World government bond yield spreads are still at healthy levels, roughtly the same as in Q2/2022.

Strong economic outlook in developing and developed economies

World Composite PMI was 53.5 at the end of June, which is still healthy reading of composite economic activity across the world. All major economies composite have PMIs over 50, with India and Brazil leading the pack. Strong dollar or price pressures haven’t still had a material effect on business outlook either in developed or developing economies. China has also managed to get back above 50, with COVID-19 related restrictions easing.

Yield spreads have tightened slightly in one and three month timescales, but are still wider than at the start of the year.

Thoughts on Q3/2022

World stock markets have continued to show weakness and major markets have dipped into bear territory. Economic indicators don’t seem to support the recession thesis so far, especially with yield spreads being on healthy levels.