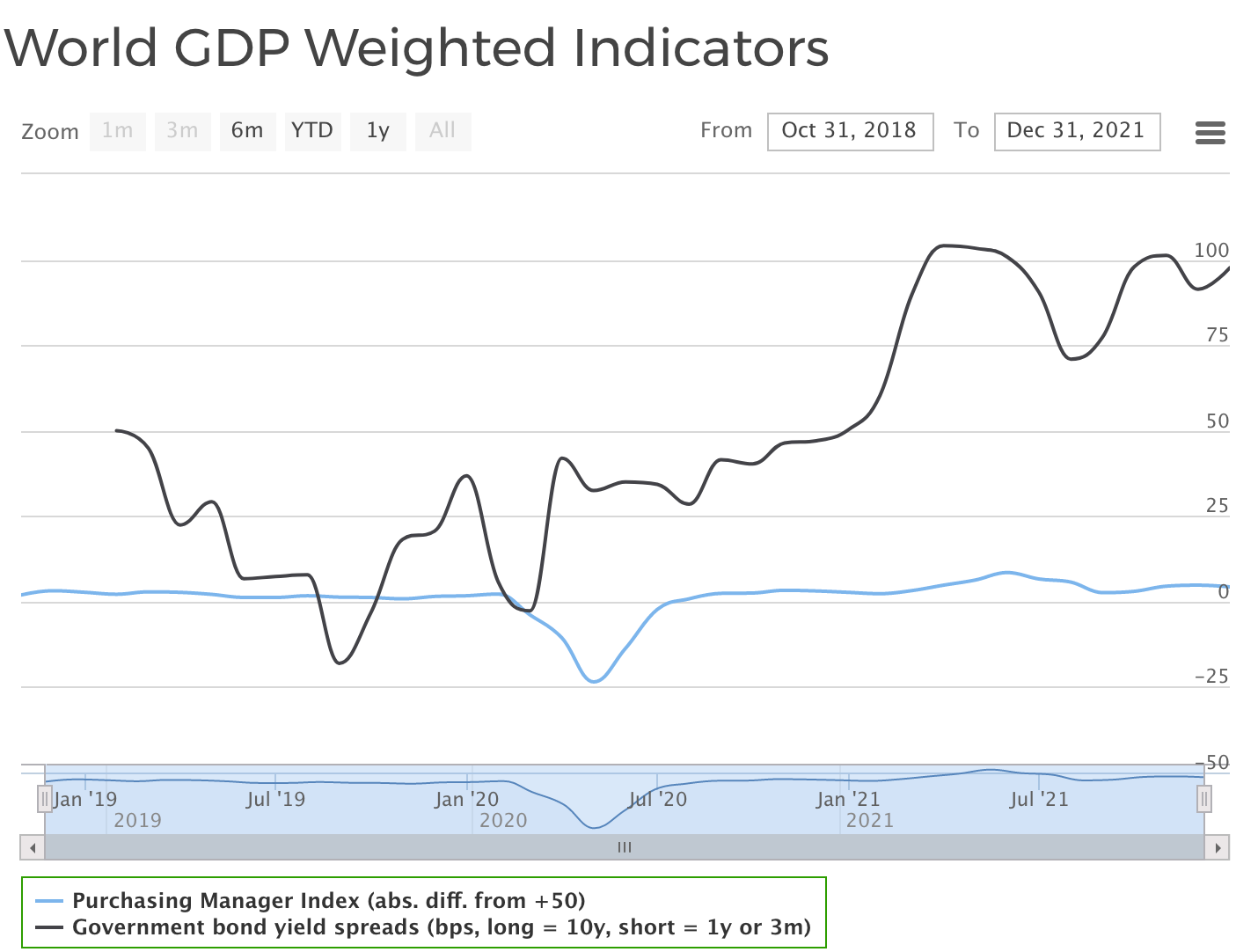

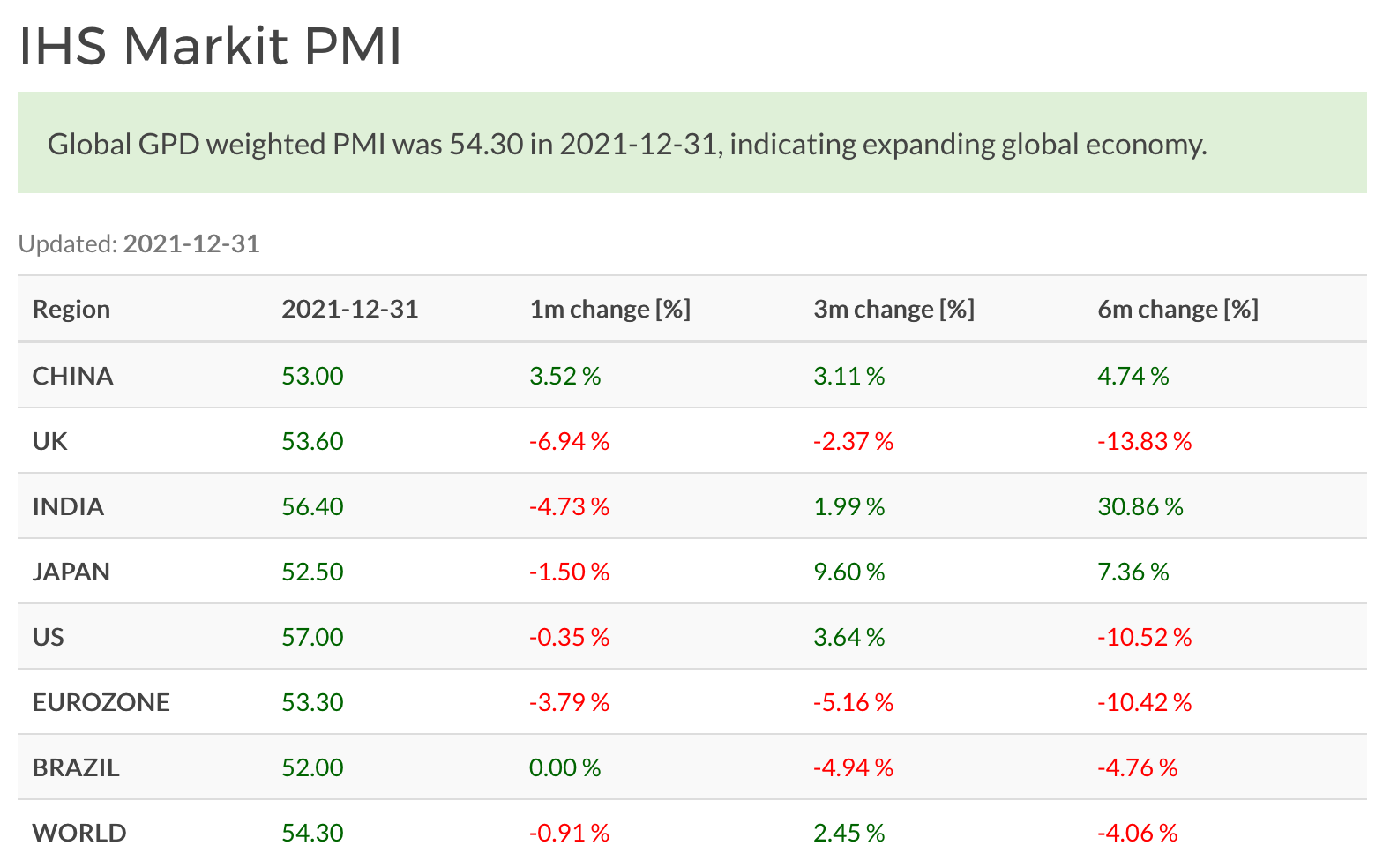

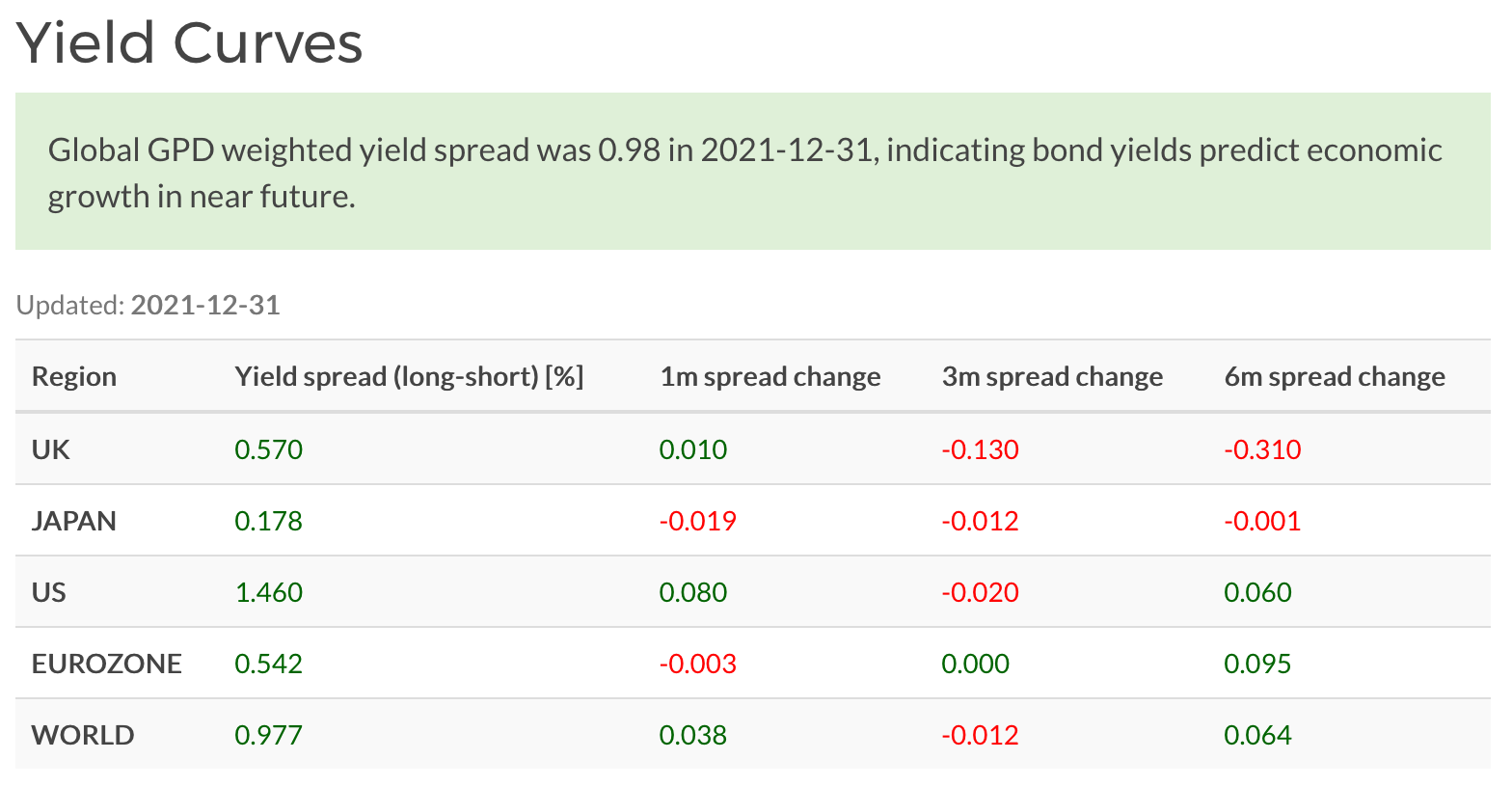

Salkku economic indicators for Q1 of 2022 are overall indicating a growing and healthy world economy. World Composite PMI is indicating improving outlook for business expectations for the start of the year. World government bond yield spreads widened compared to Q4/2021 and 6 months ago.

Strong outlook in all major economies

World Composite PMI was 54.3, indicating positive expectations for combined service and manufacturing sectors. All major economies have composite PMIs over 50.

Yield spreads have again widened to their widest they’ve been in three years. This means that bond markets are not indicating economic cycle peak and we still have some years to run this bull run.

Thoughts on Q1/2022

World stock markets (MSCI World Index) have formed a double top pattern with tops in November and December. While this is usually a bearish pattern, economic indicators do not signal peak cycle yet. Even inflation scare has not affected bond or stock markets in any meaningful way. All in all economic (and investment) environment looks healthy at the start of 2022.