Onset of global slowdown coincided with coronavirus rendered leading indicators useless, as stock markets took a sharp downturn at the beginning of March. Leading indicators LEI and composite PMI indicated slowing global economy already in February, but those readings came just after market crashed and were of little help for forecasters. Such is the nature of black swans.

Expansion cut short by COVID-19 pandemic

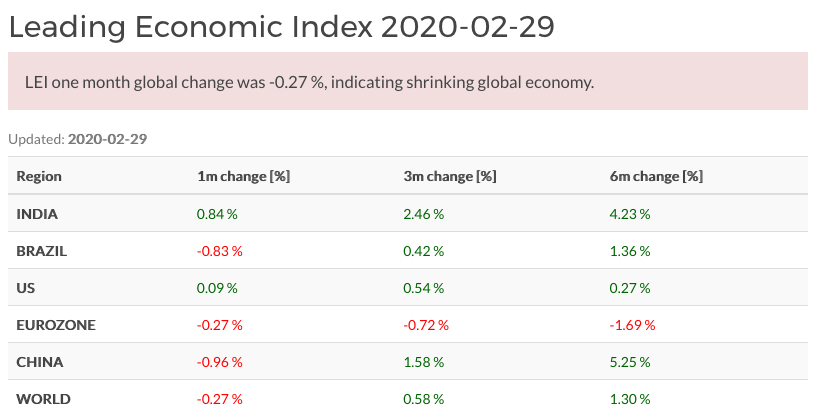

In February, one month change of Leading Economic Index by The Conference Board indicated slowing economy in China, Brazil and eurozone, while US and India were still growing. This pushed the overall GDP weighted world LEI into negative territory. GDP weighted world LEI was still growing in three and six month timescales.

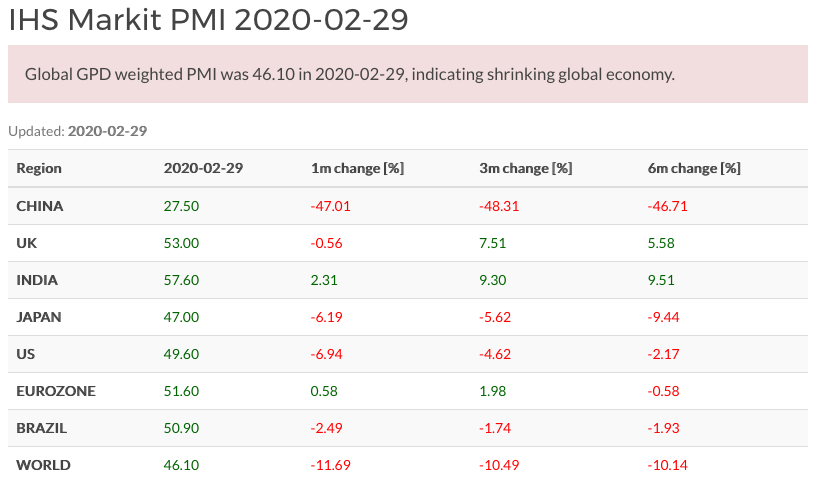

World Composite PMI was 46.1 in February, indicating sharply contracting global economy. Main region responsible for slowdown was China, which was first hit by COVID-19 pandemic, posting lowest composite PMI reading in record. March PMI readings are already significantly worse.

2020 outlook

2020 outlook seems rather murky, since we are suffering from lack of visibility into the overall effect and duration of COVID-19 pandemic. Already it is quite clear shutdowns and movement restrictions are causing significant economic damage all over the world. It seems restrictions might be proving effective in slowing down the pandemic, hence giving some hope that eventually they could be lifted sooner rather than later.

Paradoxically, for long term stock market investors, even in severe downturns like this it’s usually better to wait instead of capitulating to grim headlines. Stock markets usually anticipate things 3-12 months ahead, and are capable of turning very quickly even while news might still be full of doom and gloom.

Even pandemics shall pass, eventually.